Someone else has already started a 'Trade the Plan' thread, so i have shortened my preferred title!

I am combining a couple of systems, so i will try to explain as i go along, rather than list all criteria here in the title.

I am basing my trading method on a style i learnt from a brilliant trader with the handle 'Divergence'. He selflessly shares this method on a thread under 'Trading Systems', so whereas, i wanted to start a thread, i thought i would list it under 'Traders Journals' instead.

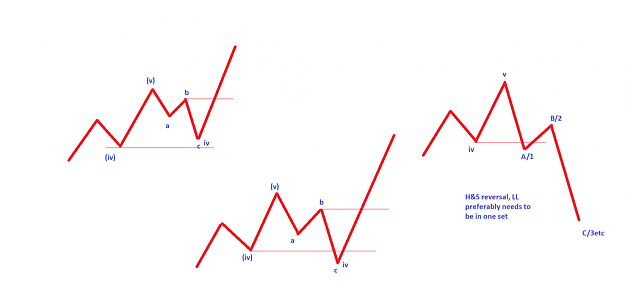

I will include some Elliott Wave work within my own style.

Two of the main variants that i will be looking for are the following;

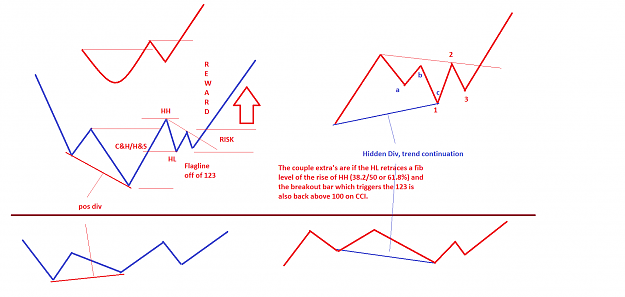

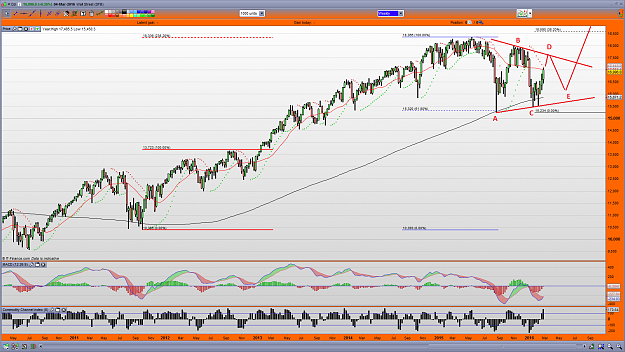

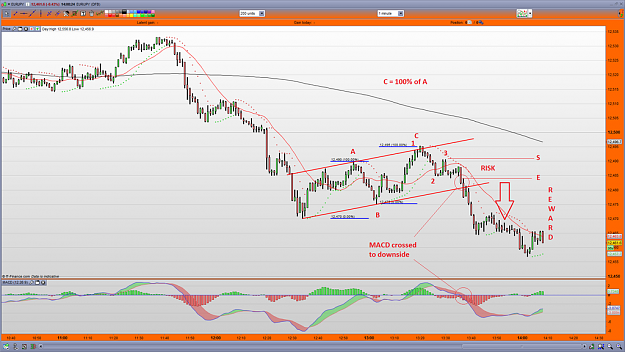

Firstly a Cup & Handle or Head & Shoulders set up, which can be either as trend change or trend continuation (after a pullback). I think it is self explanatory.

The second is a pullback within trend, followed by a 123 or a flagline, (but preferably both). The 123 can be used as entry back into trend. Looking for divergence in both instances will be important. Regular together with the first and Hidden divergence for trend continuation.

1) Determine a trend (HH/HL or LL/LH's)

2) Wait for a pullback

3) Enter back into main trend with a 123

4) Manage trade

I am combining a couple of systems, so i will try to explain as i go along, rather than list all criteria here in the title.

I am basing my trading method on a style i learnt from a brilliant trader with the handle 'Divergence'. He selflessly shares this method on a thread under 'Trading Systems', so whereas, i wanted to start a thread, i thought i would list it under 'Traders Journals' instead.

I will include some Elliott Wave work within my own style.

Two of the main variants that i will be looking for are the following;

Firstly a Cup & Handle or Head & Shoulders set up, which can be either as trend change or trend continuation (after a pullback). I think it is self explanatory.

The second is a pullback within trend, followed by a 123 or a flagline, (but preferably both). The 123 can be used as entry back into trend. Looking for divergence in both instances will be important. Regular together with the first and Hidden divergence for trend continuation.

1) Determine a trend (HH/HL or LL/LH's)

2) Wait for a pullback

3) Enter back into main trend with a 123

4) Manage trade

GoFundMe -stage-4-glioma-brain-cancer-fighter (link in my profile)