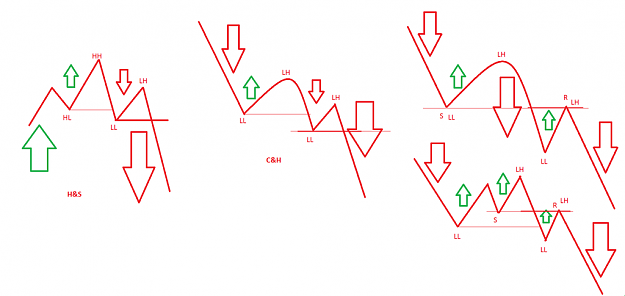

Here's a couple variations of the C&H set-up that i have observed;

If PA extends before a pullback when the LL (or HH for longs) is created, expect the prior peak to become resistance (or support for longs)

If the bowl or cup has a spike within it, this often becomes the S/R level itself (as in RHS lower illustration).

I missed this earlier on the EurJpy;

It appears quite common that the handle of the larger bowl, is a smaller replica of what came before.

In all honesty, i am certain that if i had traded the first larger set-up, i would have been stopped out on the second retest.

If PA extends before a pullback when the LL (or HH for longs) is created, expect the prior peak to become resistance (or support for longs)

If the bowl or cup has a spike within it, this often becomes the S/R level itself (as in RHS lower illustration).

I missed this earlier on the EurJpy;

It appears quite common that the handle of the larger bowl, is a smaller replica of what came before.

In all honesty, i am certain that if i had traded the first larger set-up, i would have been stopped out on the second retest.

GoFundMe -stage-4-glioma-brain-cancer-fighter (link in my profile)