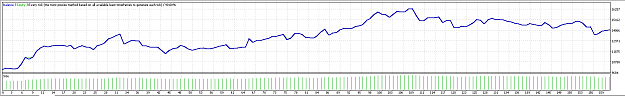

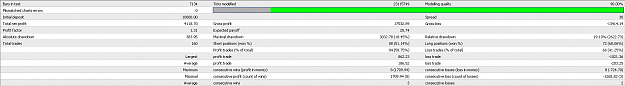

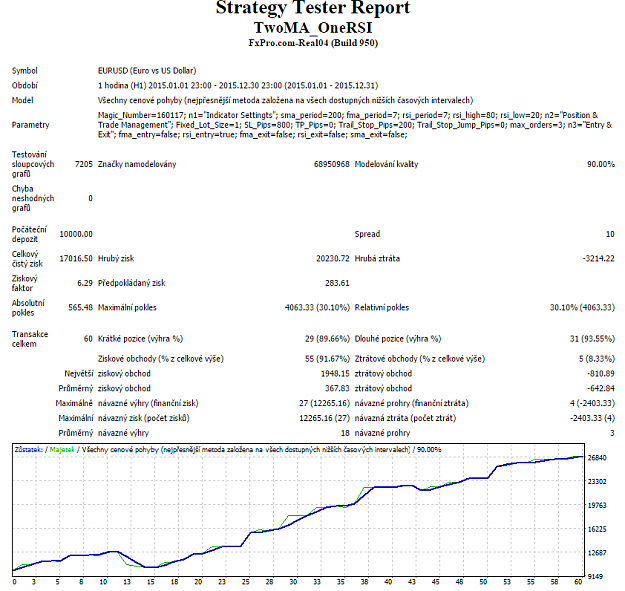

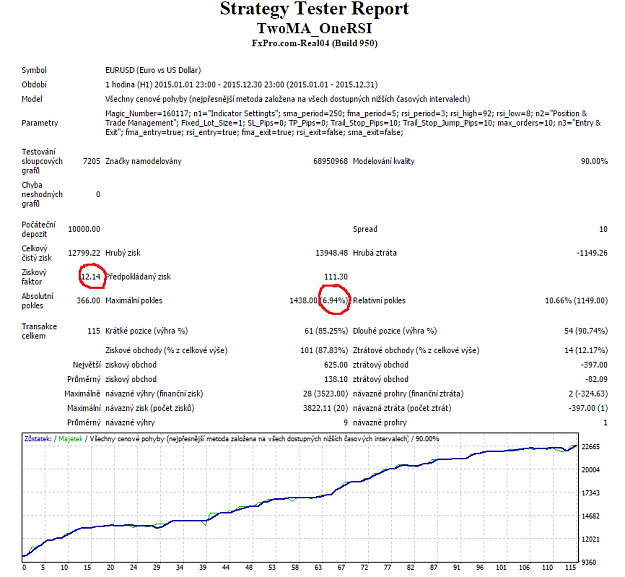

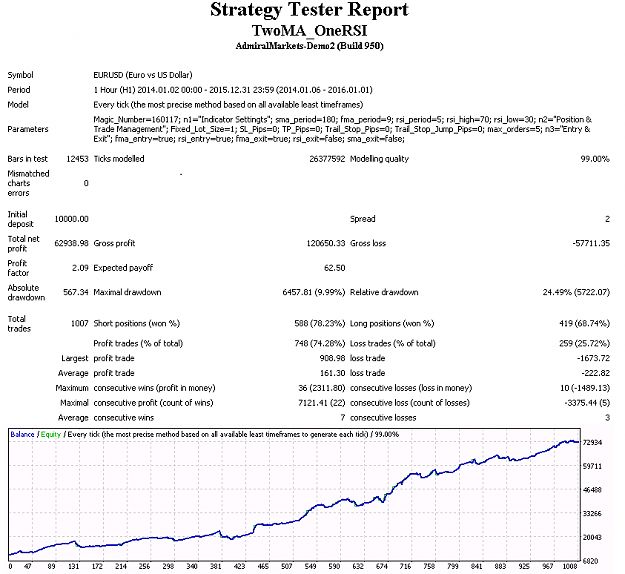

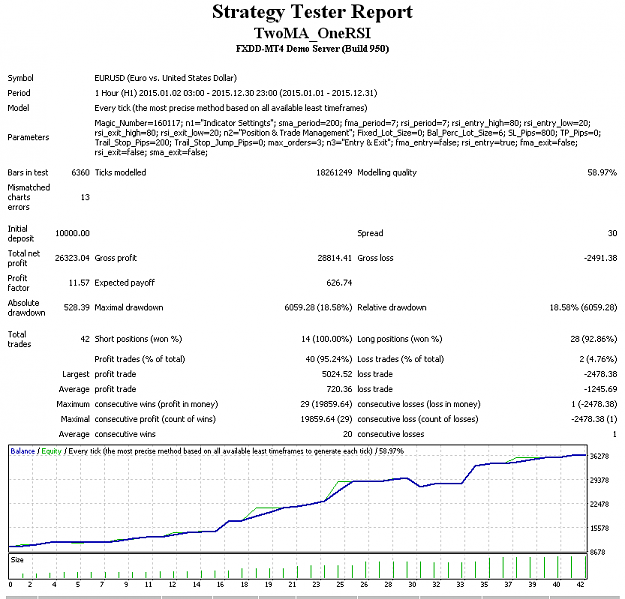

DislikedMy findings so far : The system is sound and can be applied to different time frames, although sys recommended Daily, my focus was mainly on H1 in order to get more trades. EUR/USD Test H1 2015. {image} Best Entry : - Open Long : RSI < lower level, while Price above Slow Moving Average - Open Short : RSI > upper level, while Price below Slow Moving Average Best Exit (when none of SL, TP,Trailing Stop used) - Exit Long: when price closes above fast moving average - Exit Short : when price closes below fast moving average EDIT : This test was run...Ignored

This is using a 7 & 200 MA, 7 RSI(20 buy level & 80 sell level), Spread is set to 30 and the modeling quality was 90%.