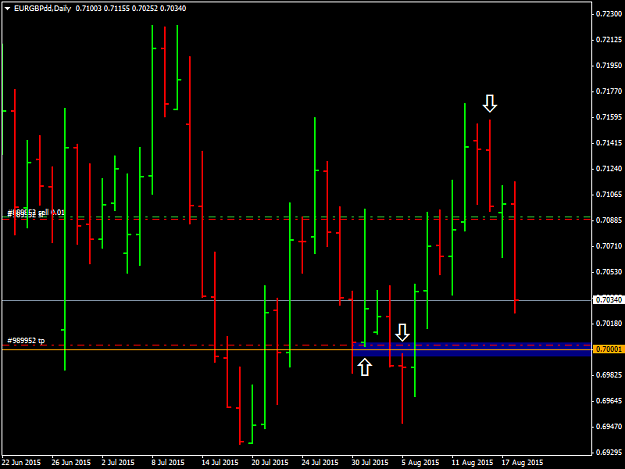

Disliked{quote} Hey K Sorry to hear you are discouraged. This is part of trading though you have to learn from your mistakes that takes a lot of time and patience. Losses are of course a part of the game. R:R is always relative to how you get into and out of your trades. R:R is a misunderstood topic in all of trading The problem here wasn't so much even the trade you took as opposed to HOW you trade it. It was misplayed from the start which is going to both cause you poor R:R , get yourself into trouble. The situation is price is in a small box and formed...Ignored

- Post #136,522

- Quote

- Edited 5:57am Aug 18, 2015 12:58am | Edited 5:57am

- Joined May 2011 | Status: Member | 1,233 Posts

Undisciplined, impatient and unruly. Don't follow me kid.

- Post #136,523

- Quote

- Aug 18, 2015 1:19am Aug 18, 2015 1:19am

- | Joined Aug 2013 | Status: Member | 1,289 Posts

- Post #136,524

- Quote

- Aug 18, 2015 1:24am Aug 18, 2015 1:24am

- | Joined Aug 2013 | Status: Member | 1,289 Posts

- Post #136,525

- Quote

- Aug 18, 2015 2:05am Aug 18, 2015 2:05am

Had to be me. Someone else might have gotten it wrong.

- Post #136,526

- Quote

- Edited 6:28am Aug 18, 2015 2:24am | Edited 6:28am

- Joined May 2011 | Status: Member | 1,233 Posts

Undisciplined, impatient and unruly. Don't follow me kid.

- Post #136,528

- Quote

- Aug 18, 2015 7:23am Aug 18, 2015 7:23am

- Joined May 2011 | Status: Member | 1,233 Posts

Undisciplined, impatient and unruly. Don't follow me kid.

- Post #136,530

- Quote

- Edited 9:20am Aug 18, 2015 8:42am | Edited 9:20am

- Joined May 2011 | Status: Member | 1,233 Posts

Undisciplined, impatient and unruly. Don't follow me kid.

- Post #136,531

- Quote

- Aug 18, 2015 9:01am Aug 18, 2015 9:01am

- Joined Sep 2006 | Status: Member | 10,132 Posts

every Saint has a past. Every Sinner has a Future

- Post #136,533

- Quote

- Aug 18, 2015 9:15am Aug 18, 2015 9:15am

- Joined May 2011 | Status: Member | 1,233 Posts

Undisciplined, impatient and unruly. Don't follow me kid.

- Post #136,534

- Quote

- Aug 18, 2015 9:18am Aug 18, 2015 9:18am

- Joined May 2011 | Status: Member | 1,233 Posts

Undisciplined, impatient and unruly. Don't follow me kid.

- Post #136,537

- Quote

- Aug 18, 2015 10:27am Aug 18, 2015 10:27am

- Joined May 2011 | Status: Member | 1,233 Posts

Undisciplined, impatient and unruly. Don't follow me kid.

- Post #136,539

- Quote

- Aug 18, 2015 11:04am Aug 18, 2015 11:04am

- | Joined Apr 2015 | Status: Member | 347 Posts

- Post #136,540

- Quote

- Aug 18, 2015 11:05am Aug 18, 2015 11:05am

- Joined May 2011 | Status: Member | 1,233 Posts

Undisciplined, impatient and unruly. Don't follow me kid.