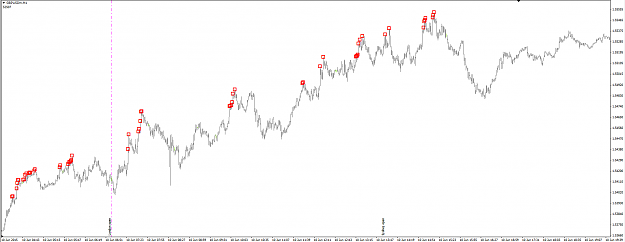

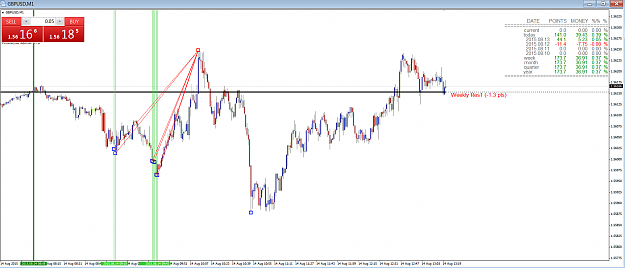

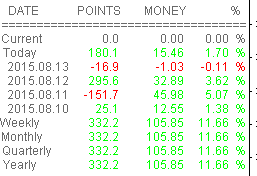

Disliked{quote} I scored +82.1 pips from 6 longs too. {image} Nice and easy! Masterrmind.........Ignored

- Joined Jun 2013 | Status: Master chaos and you master trading | 11,287 Posts

Master your Mind then Master your Trades

- Joined Jun 2013 | Status: Master chaos and you master trading | 11,287 Posts

Master your Mind then Master your Trades

- Joined Jun 2013 | Status: Master chaos and you master trading | 11,287 Posts

Master your Mind then Master your Trades