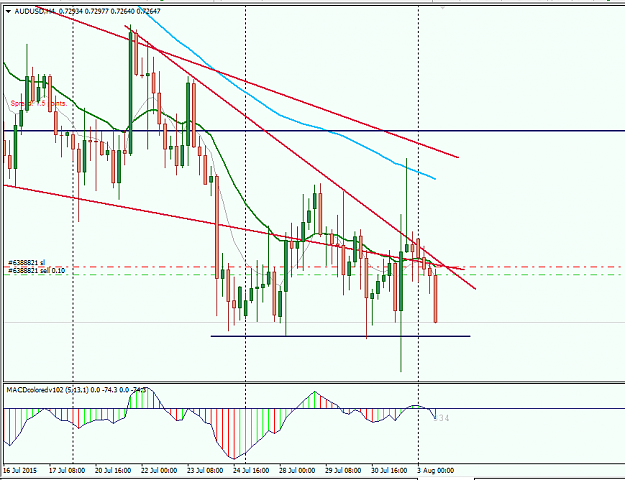

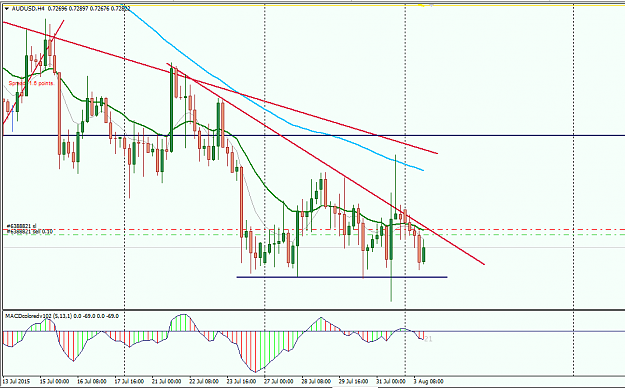

August 3rd, 2015: AUDUSD (4 HOUR): 8:00 candle

The day is bright and fair!

Continued from previous analysis as revealed by my chart in previous posts.

Happy trading!

The day is bright and fair!

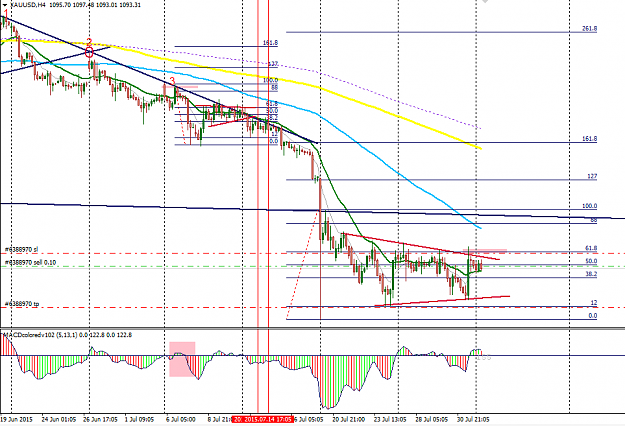

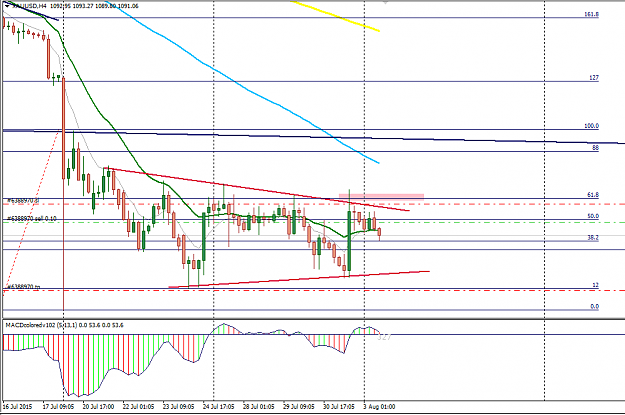

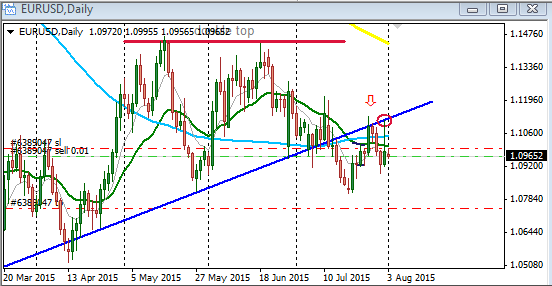

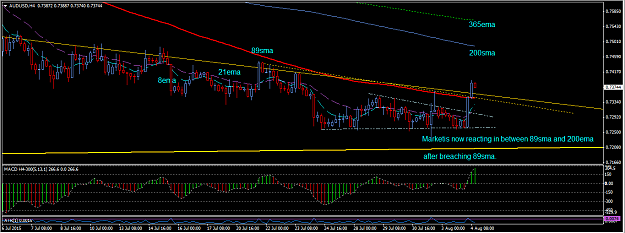

Continued from previous analysis as revealed by my chart in previous posts.

Happy trading!