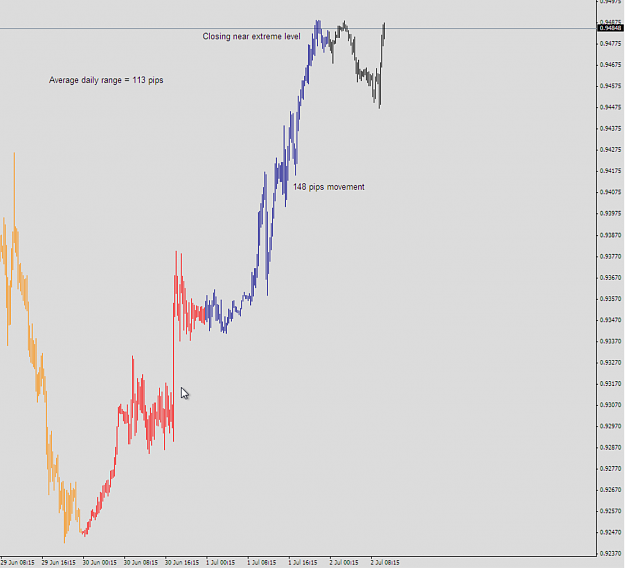

I use a combination of two variables to define a trend;

1. If price have moved above daily average range (based on the 30 past days)

2. Daily closing price near high/low

Take usd/chf for example. The 30 days average range is 113 pips. Yesterday it moved almost 150 pips (which is of course above daily average) and closed near the session high. What usually (remember, there are on guarantees in trading) follows, is a move in the same direction. As with any information on this forum, dont swallow it raw - find out for yourself if this is true.

1. If price have moved above daily average range (based on the 30 past days)

2. Daily closing price near high/low

Take usd/chf for example. The 30 days average range is 113 pips. Yesterday it moved almost 150 pips (which is of course above daily average) and closed near the session high. What usually (remember, there are on guarantees in trading) follows, is a move in the same direction. As with any information on this forum, dont swallow it raw - find out for yourself if this is true.

Measure twice, cut once