Hi to every one!

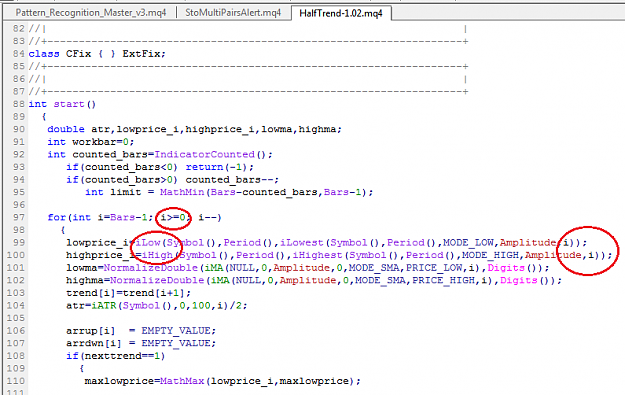

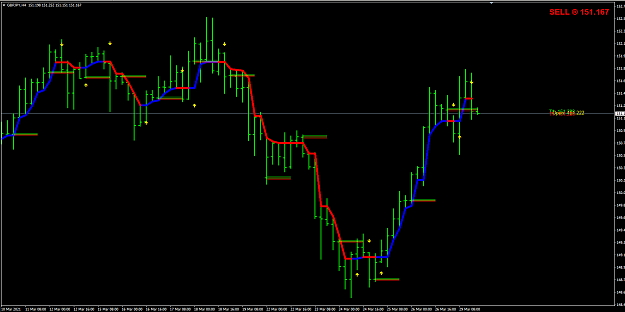

This strategy use only one indicator: the Half trend indicator .

The goal of this strategy is to get as surely as possible 10 pips for each trade. It dont follow the entire trend which can develope after a Half Trend signal. It can be a big waste, but what I want is 10 pips for each trade. Stop.

Because it may offer false signals we go to use a grid strategy each time we open a new trade.

Time Frame: M5

It is a MUST to trade only in London and New York sessions.

Pairs: all with a broker which offers low spread as possible. I trade with 30 pairs.

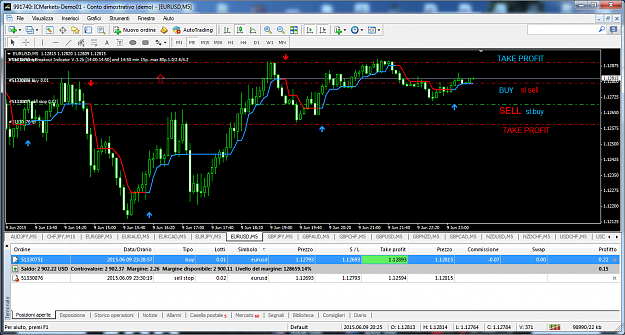

Example: Signal trade of Half Trend indicator: SELL EurUsd.

We enter in the market with a SELL ORDER at 1.12500: SL + 100 pipettes = 1.12600; TP - 100 pipettes= 1.12400.

Lotes: for example 0.01

Then we open quickly a BUY PENDING ORDER at (Sell + 100 pipettes) = 1.12600; SL - 100 pipettes= 1.12500 TP + 100 pipettes= 1.12700

Lotes : 0.02 (Martingale sequence)

So you can see that 1) Sell order = SL of buy pendig order:

2)Buy pendig order is = SL of Sell order.

In this way it is easy to see if we did set correctly our orders.

When a Stop Loss is hit, we will go to open the SAME TRADE with the double of the value of the last lot. (f.e. 0.01, 0.02, 0.04, 0.08 ecc.)

The price may bounch from a level to the other while we increase the value of the lots until it hit a Take Profit.

When it happens we MUST remember to delete the last pending order.

To avoid many bounches which can encreasy the martingale sequence I advise to trade only in a plenty market hours with medium/high volatility.

Take care the time near to the foundamentals news. The price can jump from a side to the other so quickly that you cant be in time to upload the trades.

The grid scheme is the same for Buy order: Open a Buy; SL -100; TP +100; then: Sell Stop - 100 pipettes far away from buy order; SL + 100; TP - 100

Each time which appears a new signal of the Half Trend indicator I open a grid scheme of the Double Level strategy.

Look at: this grid scheme may be dangerous. So I recommend to not exager with martingale sequence maximum 3/4 steps and dont exceed with lots. Then accept to have lost your money for that trade. But dont worry: it wll be always possible to recover the money losted if you trade in the right sessions and how much pairs as possible.

The trading system is propoused in a "scalping way" , but it is flexible for others time frames and with differents setups Buy/Sell - SL/TP levels, changing the basic spread between the orders (100,200,300,500,1000 pipettes). So everyone can adjust this strategy with different timeframes, different spread, different lots, following his own needs. and possibilities.

You need to pratice this scheme with one pair, so you can improve your speedy to calculate the levels without calculator and insert the orders.

Maybe it is possible to realize an EA with this system.

Thatīs all. Any critic, suggestion and improvement is welcome.

This strategy use only one indicator: the Half trend indicator .

The goal of this strategy is to get as surely as possible 10 pips for each trade. It dont follow the entire trend which can develope after a Half Trend signal. It can be a big waste, but what I want is 10 pips for each trade. Stop.

Because it may offer false signals we go to use a grid strategy each time we open a new trade.

Time Frame: M5

It is a MUST to trade only in London and New York sessions.

Pairs: all with a broker which offers low spread as possible. I trade with 30 pairs.

Example: Signal trade of Half Trend indicator: SELL EurUsd.

We enter in the market with a SELL ORDER at 1.12500: SL + 100 pipettes = 1.12600; TP - 100 pipettes= 1.12400.

Lotes: for example 0.01

Then we open quickly a BUY PENDING ORDER at (Sell + 100 pipettes) = 1.12600; SL - 100 pipettes= 1.12500 TP + 100 pipettes= 1.12700

Lotes : 0.02 (Martingale sequence)

So you can see that 1) Sell order = SL of buy pendig order:

2)Buy pendig order is = SL of Sell order.

In this way it is easy to see if we did set correctly our orders.

When a Stop Loss is hit, we will go to open the SAME TRADE with the double of the value of the last lot. (f.e. 0.01, 0.02, 0.04, 0.08 ecc.)

The price may bounch from a level to the other while we increase the value of the lots until it hit a Take Profit.

When it happens we MUST remember to delete the last pending order.

To avoid many bounches which can encreasy the martingale sequence I advise to trade only in a plenty market hours with medium/high volatility.

Take care the time near to the foundamentals news. The price can jump from a side to the other so quickly that you cant be in time to upload the trades.

The grid scheme is the same for Buy order: Open a Buy; SL -100; TP +100; then: Sell Stop - 100 pipettes far away from buy order; SL + 100; TP - 100

Each time which appears a new signal of the Half Trend indicator I open a grid scheme of the Double Level strategy.

Look at: this grid scheme may be dangerous. So I recommend to not exager with martingale sequence maximum 3/4 steps and dont exceed with lots. Then accept to have lost your money for that trade. But dont worry: it wll be always possible to recover the money losted if you trade in the right sessions and how much pairs as possible.

The trading system is propoused in a "scalping way" , but it is flexible for others time frames and with differents setups Buy/Sell - SL/TP levels, changing the basic spread between the orders (100,200,300,500,1000 pipettes). So everyone can adjust this strategy with different timeframes, different spread, different lots, following his own needs. and possibilities.

You need to pratice this scheme with one pair, so you can improve your speedy to calculate the levels without calculator and insert the orders.

Maybe it is possible to realize an EA with this system.

Thatīs all. Any critic, suggestion and improvement is welcome.

Attached File(s)