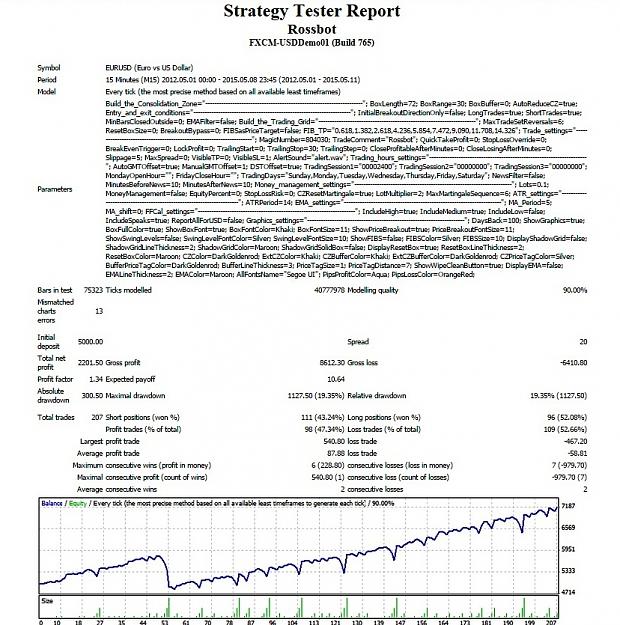

oh the long block. my mind went straight to motors. if you read the thread why didn't you say extended cz? then we all would of known what you were talking about. the purpose of the extended cz is just that, its a "qualified" cz that continues in that price range.

- Post #7,561

- Quote

- Mar 11, 2015 9:38pm Mar 11, 2015 9:38pm

- | Joined Mar 2014 | Status: Member | 49 Posts

- Post #7,568

- Quote

- Apr 8, 2015 6:42am Apr 8, 2015 6:42am

- | Joined Apr 2013 | Status: Member | 6 Posts

- Post #7,570

- Quote

- Apr 16, 2015 10:56am Apr 16, 2015 10:56am

- | Joined Apr 2013 | Status: Member | 6 Posts

- Post #7,571

- Quote

- Apr 18, 2015 6:37am Apr 18, 2015 6:37am

- Joined Oct 2005 | Status: Pip Slappa Extrordinaire | 1,012 Posts

You are in a maze of twisty little passages, all alike.

- Post #7,572

- Quote

- Apr 20, 2015 8:02am Apr 20, 2015 8:02am

- | Joined Apr 2013 | Status: Member | 6 Posts

- Post #7,579

- Quote

- Jun 1, 2015 8:26am Jun 1, 2015 8:26am

- | Joined Dec 2007 | Status: Member | 18 Posts