Disliked{quote} Just to give my 2 cents as well, I was doing something the same thing at the end of last year and completely ignoring the MA even though it was on my chart. Pres said the same to me that he has said to you. Once I started paying attention and going long above it, short below. It made a huge difference to my trading and completed another step on the way to what is my strategy. So for now, i'd recommend doing the same. Yes you might miss moves but you might be surprised how well it sticks to it. I took a short trade today, entry below the...Ignored

Excuse the random post, I would like to start threads and a journal and need a few posts first.

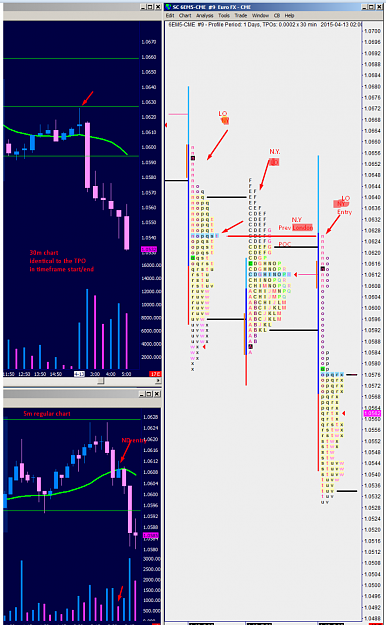

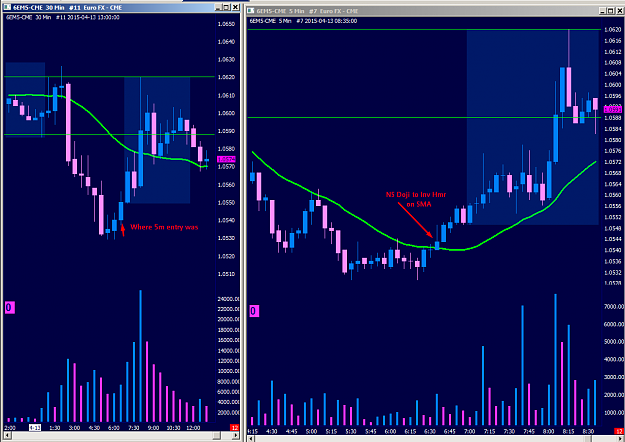

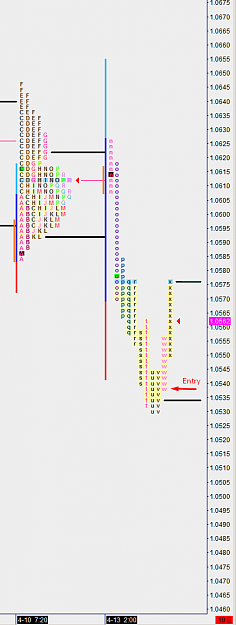

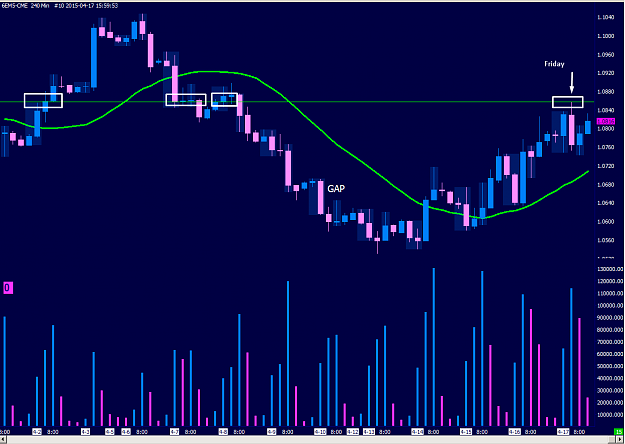

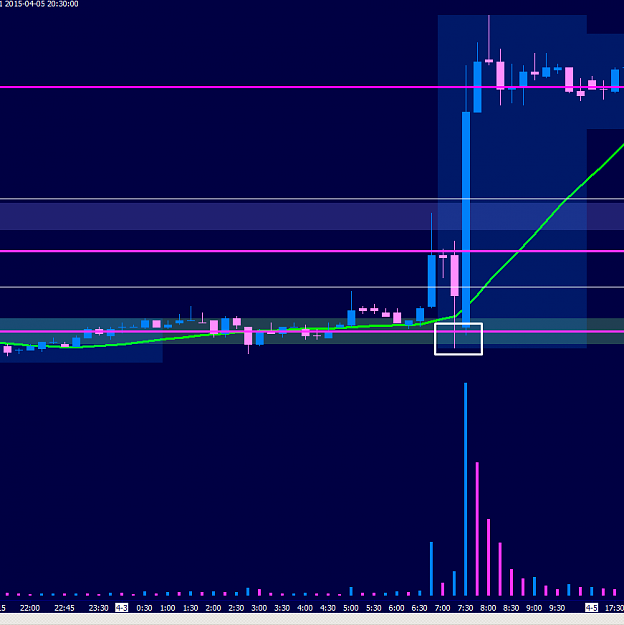

We opened at Friday POC of N.Y. for London in value. Straight shot up to Friday POC for London. I take high probability trades at high probability points in

the moment, not because I'm impatient, it's all just probabilities and I don't care what the outcome is.

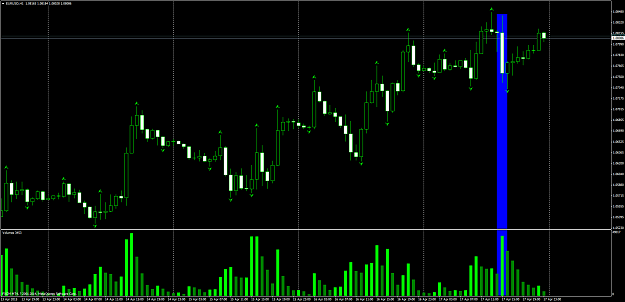

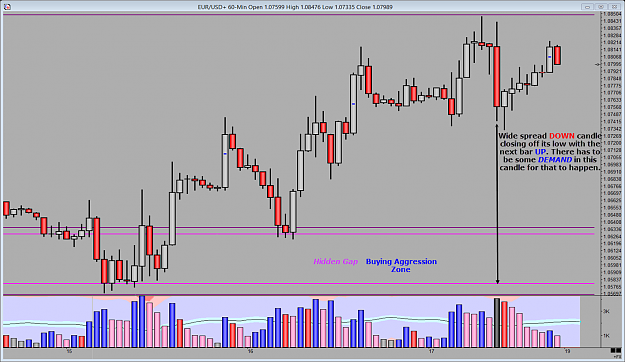

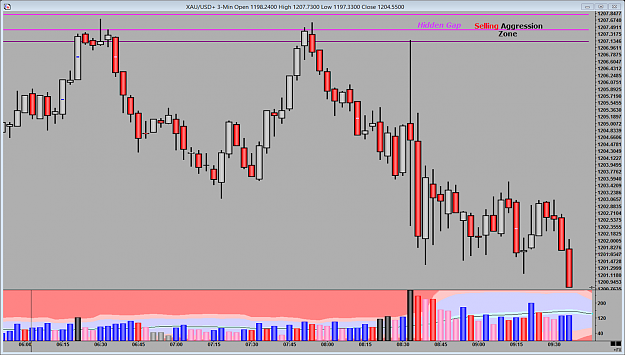

I have a hyper aggressive style, ruled by VSA, WSB, and MP (Master the Markets, Markets in Profile, (The Poker Mindset &Theory of Poker) Trading in the Zone)) , I use the 21 SMA as reference only and take trades more aggressively according to it, but never let it stop me from getting in when I see a signal. Not for the faint of heart. Don't miss nearly as many moves, but do get run over occasionally.

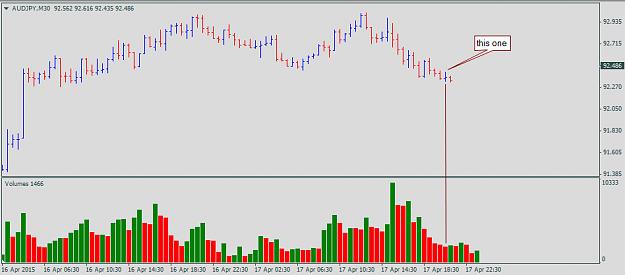

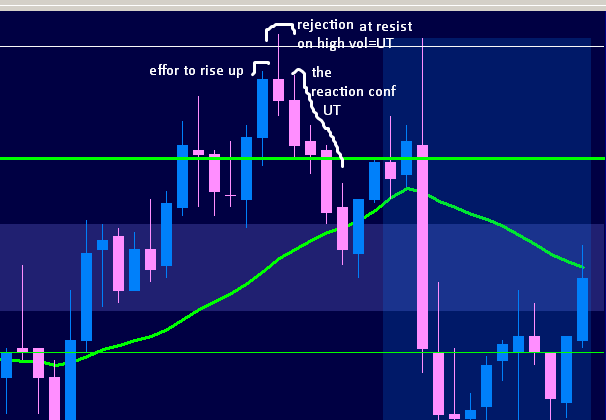

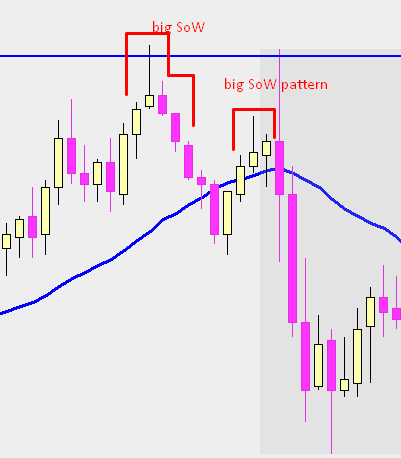

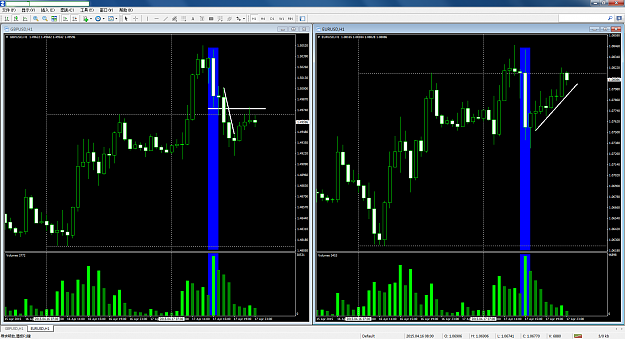

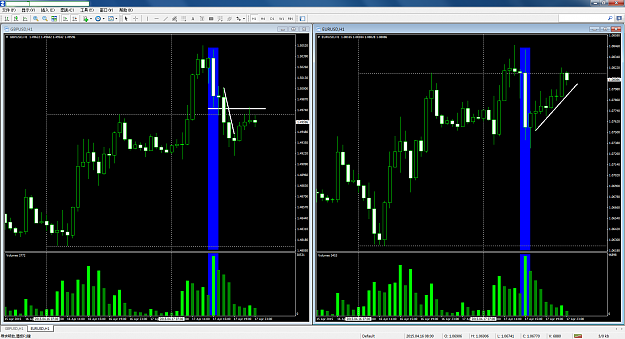

There is a regular 5 min chart (the bottom left one) still showing a perfect entry, ND on the SMA, for 'early adopter' entry. Also note the 5m candle patterns at the top where innovator trade was taken, fake UT (called that for short, obviously it could be profit taking, stop hunt etc), Hang man, Doji, to real UT. I'd take the 5m ND if I missed the innovative trade, perfect entry after weakness from UT. My entry's are rather good but I exit way too early, must work on that. I like what HG does with exiting after WSB etc, going to try and incorporate that.

Hope the image posts, I can't see it in preview.

Once I can post I'll have a journal so I don't have to Monday morning quarterback : )