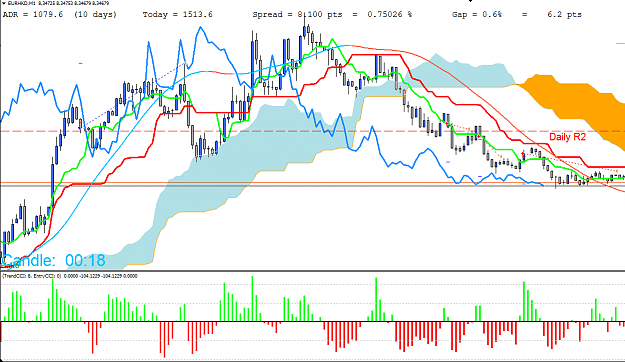

DislikedIm recovering from very bad lossers (-38) two of them for entrys not by the rules thinking it will go down and one that was +10 and Im not go for the BE and end being a losser. Just with this last 2 Im recover some. {image}Ignored

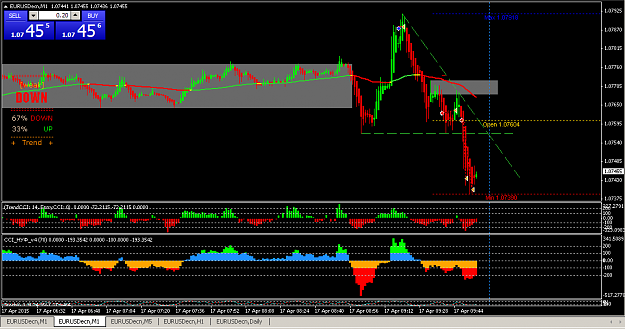

However it is another way to trade top trenders as very often they will reverse on you especially in rangy old days, so its good to have a reversal signal that you're ready to trade when you see the trends faltering, heres my reversal signal...

I gotta say I'm a trend trader through and through until I see the reversal setup of LLLH in an uptrend or a HHHL in a downtrend, you have to see the two together before trading reversals..Then what you're doing is still trading with the trend but the very first pullback in the new trend... Take the CCI signal but get to BE quickly just in case...

Use the CCI signals and reference the last with the current one to see how it relates so constantly checking market structure as you trade.

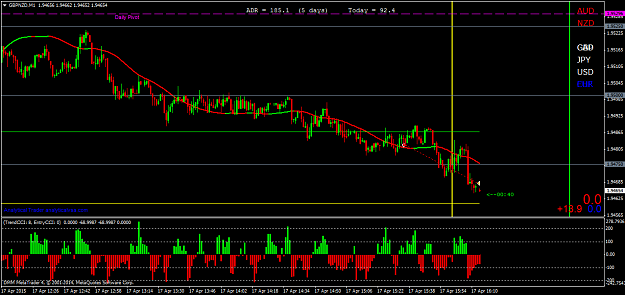

Its very much in vogue with the "take the first 2 CCI signals " after the 120hma changes colour.. Heres what I'm talking about on GBPAUD..

Lets assume you're trading this GBPAUD move up so its a strong uptrender with the CCI giving you the waves and by referencing one CCI against the last you can see a nice HLHH upward moving structure, then you get your first CCI wave down taking the last HL out producing your 1st LL, now if the next CCI turn down is lower than the one before you have a tradable sell signal...

That price has also dropped below the 120HMA is also a good sign and its turning red or at least flattening out. But to be honest its the market structure not the moving average that gives you the signal... Its also really important to see that market structure complete, eg wait for the LL before selling a LH.

I'm always referencing the current CCI to its last one whenever I'm trading they define the waves very well and are a good way of confirming the market structure is still in sequence and therefore the trend is still going strong, any break in that sequence HHHL in an uptrend or LHLL in a downtrend, is the first sign your trend could be in trouble..

Feel the Fear and do it anyway!!!