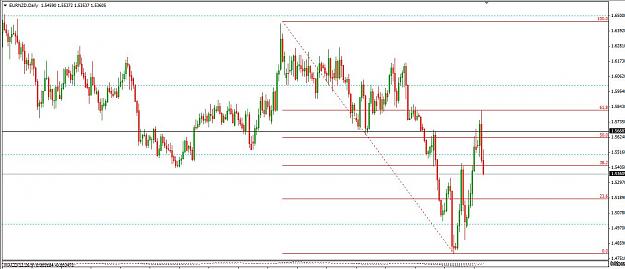

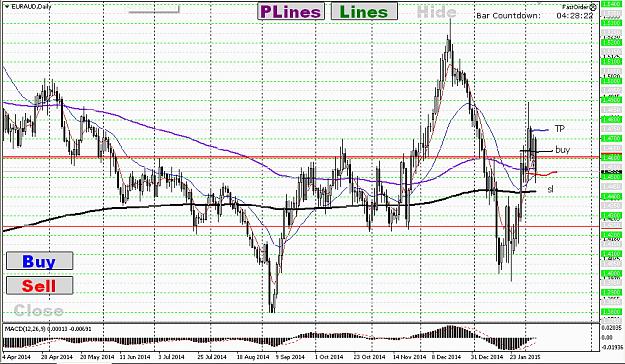

Missed on a pin bar trade because of distractions. Here is the chart.

- Post #133,743

- Quote

- Feb 4, 2015 5:09pm Feb 4, 2015 5:09pm

“Life breaks free. Life expands to new territories.

- Post #133,747

- Quote

- Feb 5, 2015 5:47am Feb 5, 2015 5:47am

We are what we repeatedly do. Excellence, then, is not an act, but a habit

- Post #133,748

- Quote

- Feb 5, 2015 9:37am Feb 5, 2015 9:37am

- | Commercial Member | Joined Aug 2006 | 12,004 Posts

- Post #133,749

- Quote

- Feb 5, 2015 10:03am Feb 5, 2015 10:03am

We are what we repeatedly do. Excellence, then, is not an act, but a habit

- Post #133,750

- Quote

- Feb 5, 2015 10:22am Feb 5, 2015 10:22am

- | Commercial Member | Joined Aug 2006 | 12,004 Posts

- Post #133,752

- Quote

- Feb 5, 2015 10:40am Feb 5, 2015 10:40am

We are what we repeatedly do. Excellence, then, is not an act, but a habit

- Post #133,759

- Quote

- Feb 6, 2015 3:38pm Feb 6, 2015 3:38pm

- | Joined Sep 2014 | Status: Member | 148 Posts

- Post #133,760

- Quote

- Feb 6, 2015 4:24pm Feb 6, 2015 4:24pm

“Life breaks free. Life expands to new territories.