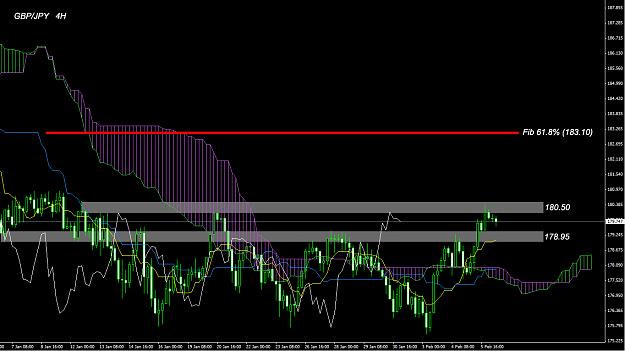

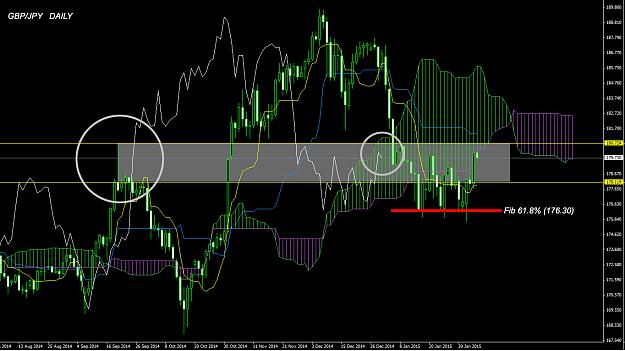

DislikedIf you all notice, we closed a daily candle with a nice, clean bullish candle. I am looking at a slight retracement back to 179.80 or so. Maybe with news we will get a whip, but who knows! Don't panic! This is just my observation! We didn't get a spike at the end of the daily or the 4 hr. so I'm in with the trend until I get some long term confirmation we are going south! Just sayin!Ignored

Be humble or be humbled.