Hi,

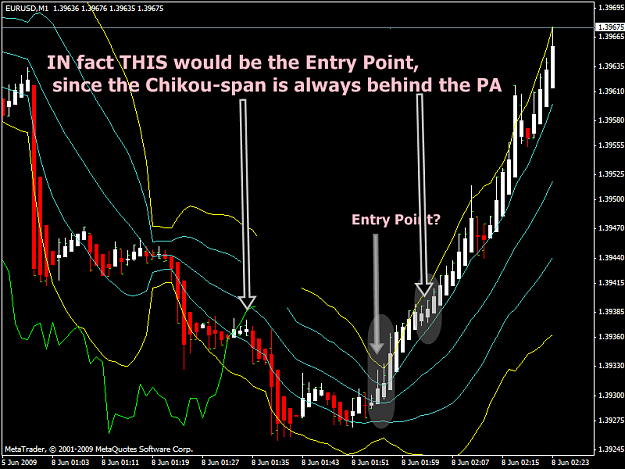

I am looking for some information on the Borihei-Dragon scalping system that can be viewed on many videos sites. Here's an example. The system uses the following indicators:

Bollinger Bands (20, 2) and (20, 1)

Heiken Ashi

Chinkou Span (Ichimoku)

Are there any available written rules for that system. I tried to find some but failed.

Thanks

Chamane

I am looking for some information on the Borihei-Dragon scalping system that can be viewed on many videos sites. Here's an example. The system uses the following indicators:

Bollinger Bands (20, 2) and (20, 1)

Heiken Ashi

Chinkou Span (Ichimoku)

Are there any available written rules for that system. I tried to find some but failed.

Thanks

Chamane