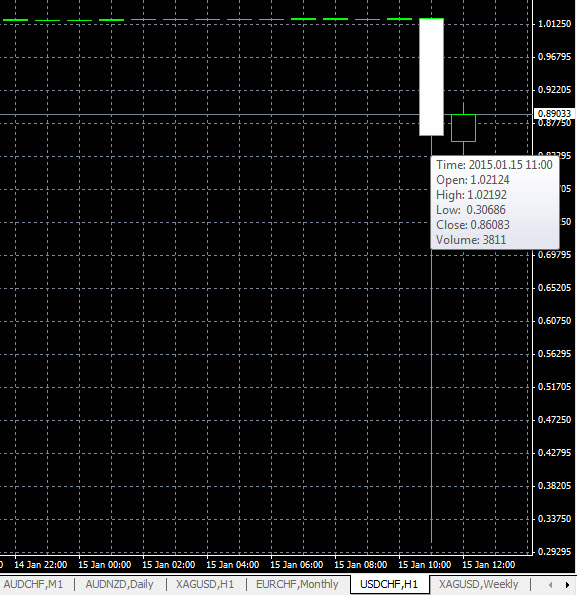

I'm not seeing 4000. I think I'm seeing a little over a 1000 unless Tradestation has it wrong.

Disliked{quote} If 30 Pips equal 1%, and the pair drop 4000 pips that equates too 133%.. = account bust.Ignored

SPC * Swollen PocketZ Crew!