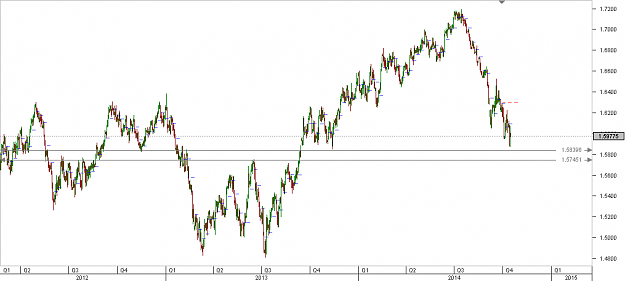

DislikedHi folksmissing since a looooooong time! don't even remember when was last time i came over FF. well, i had many reasons for that! now everything is (almost) accomplished and I'm trying to give a serious look on some charts. For the moment I'm wondering how much the EUR CHF will keep stable between 1.20 and 1.22: could be one year or one month! {image}

Ignored

Gone to a better place