when GOD brings you a challenge he also gives you the power to deal with it

- | Membership Revoked | Joined Jun 2011 | 4,778 Posts

when GOD brings you a challenge he also gives you the power to deal with it

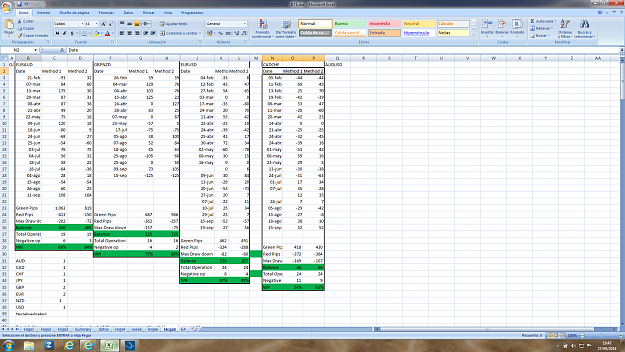

an attempt of compounding, from USD50+25bonus until ....burnout..haha

SAD swing/reversal (weekly TF) All Time Return:

-38.3%