Well I have decided to start my own journal since I have been trading more than most people on here. If you can learn something from what Im doing, more power to you. If you have questions or comments on what Im doing I would love to help and answer. I do have Skype if you want to connect off of Forex Factory; I love to connect with other traders. I did post a system about a year ago or so which they moved to who knows where but this is pretty much a variation of it with a couple other features to enhance my accuracy. The concept is to find a trend and jump in at a good level AFTER price has begun to move back in the direction of the trend. I use Stochastics, Moving Averages, and Heiken Ashi candles for this. I also have a THV indicator on the chart and that helps me determine what may be going on; it helps me let my winners run or avoid a potential trade (especially by using it on higher time frames!)

Anyways, my rules are as follows:

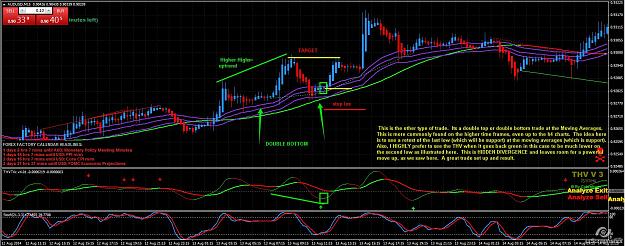

1. My 20 period moving averages must be crossed below the red/green/yellow moving average in a downtrend and the opposite is true in an uptrend.

2. Price MUST have reached the moving averages in order for a valid buy or sell trade to be in place. If price has not, it may have more room to run and I am NOT interested in a trade!

3. For a sell trade, price MUST be rejecting off of the moving averages and the HA candles MUST turn red and stochastic must cross down and have JUST crossed down from being OVERBOUGHT (over 80). If price has moved beyond ALL moving averages and not quickly rejected (wicks) I am NOT interested in the trade as that is showing too much strength in the market (or weakness). For a buy trade, the exact opposite is true for these rules. It is important to note if it does move past the MA's on that time frame, often it will set up on the next higher time frame, IF THE TREND IS THE SAME. I trade only the 5m, 15m, 30m, and 1 hour. Okay, on occassion ill do a 4 hour if it looks AWESOME. I have to be careful on the 5 tho...I am looking for SMOOTH price action...none of this all over the place price action and no major wicks. You will see what I mean as I post charts.

Also, I take into consideration support and resistance and DIVERGENCES on the THV. I do not buy at major resistance on higher time frames, neither do I sell at support! With so many pairs and multiple time frames there is ALWAYS trades to be had! If im looking to go long and major divergence is setting up on a higher time frame I stay out. Again, patience is key and there are tons of trades so cherry pick only the PERFECT ones. Even then you will have failed trades, but lets keep the win ratio high!

As far as my stop loss, its usually above resistance or below support. I define this as 00 numbers, the 60 period moving average, and price support/resistance AND daily pivots and R/S 1-3. All of those qualify. As far as take profits, I take off some once i hit the 1:1 reward to risk and the rest I let run to the last area of support and resistance. Remember, in most cases price will retest that and even plow through it if you are in a strong trend! Let the winners run! This is the key to being a profitable trader. And of course, cutting losses. Anyways, if I think of anything else Ill post it with the pictures. Thanks for reading hope you learn something

Indicators and the template are below if you care to use them.

Anyways, my rules are as follows:

1. My 20 period moving averages must be crossed below the red/green/yellow moving average in a downtrend and the opposite is true in an uptrend.

2. Price MUST have reached the moving averages in order for a valid buy or sell trade to be in place. If price has not, it may have more room to run and I am NOT interested in a trade!

3. For a sell trade, price MUST be rejecting off of the moving averages and the HA candles MUST turn red and stochastic must cross down and have JUST crossed down from being OVERBOUGHT (over 80). If price has moved beyond ALL moving averages and not quickly rejected (wicks) I am NOT interested in the trade as that is showing too much strength in the market (or weakness). For a buy trade, the exact opposite is true for these rules. It is important to note if it does move past the MA's on that time frame, often it will set up on the next higher time frame, IF THE TREND IS THE SAME. I trade only the 5m, 15m, 30m, and 1 hour. Okay, on occassion ill do a 4 hour if it looks AWESOME. I have to be careful on the 5 tho...I am looking for SMOOTH price action...none of this all over the place price action and no major wicks. You will see what I mean as I post charts.

Also, I take into consideration support and resistance and DIVERGENCES on the THV. I do not buy at major resistance on higher time frames, neither do I sell at support! With so many pairs and multiple time frames there is ALWAYS trades to be had! If im looking to go long and major divergence is setting up on a higher time frame I stay out. Again, patience is key and there are tons of trades so cherry pick only the PERFECT ones. Even then you will have failed trades, but lets keep the win ratio high!

As far as my stop loss, its usually above resistance or below support. I define this as 00 numbers, the 60 period moving average, and price support/resistance AND daily pivots and R/S 1-3. All of those qualify. As far as take profits, I take off some once i hit the 1:1 reward to risk and the rest I let run to the last area of support and resistance. Remember, in most cases price will retest that and even plow through it if you are in a strong trend! Let the winners run! This is the key to being a profitable trader. And of course, cutting losses. Anyways, if I think of anything else Ill post it with the pictures. Thanks for reading hope you learn something

Indicators and the template are below if you care to use them.

Attached File(s)