Disliked{quote} Hi Nic, sorry I cannot help you on that one. I use only the 4 hrs strategy including the figures(RT, RB, SHS,etc.)- I have never quite understood the idea on the elliot waves.Ignored

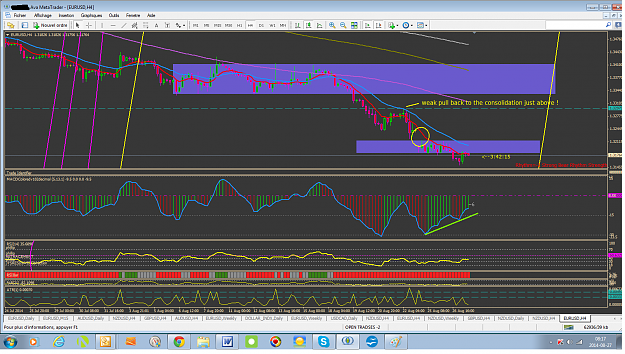

Anymore screen shots of your trades analysis with explanation.

There must be sHs coming soon as most currencies bombed last month, so profit taking this week and a correction or reverse coming soon.

Any charts?

thanking you.

ps..just changed my computer and busy swapping things over..i have mt4 but just the basics no h4 systems macd indicator installed etc..

There you go another install needed Jing....

i hate swapping computers...