Abinadi,

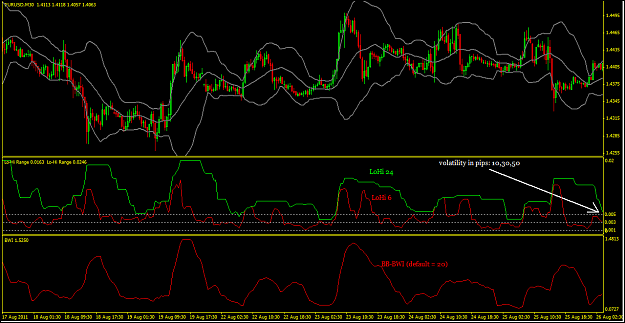

I hope you're still subscribed to this thread, because I have a suggestion for you. I am currently researching volatility myself and I was thinking maybe you could do well to try out the classic Donchian channel indicator in another form. The Donchian channel draws channels connecting the highs and lows of n periods. When volatility increases, the channel gets wider. There is an indicator called Donchian Channel Width that measures exactly that (the same principle is used on the BB width indicator, which I too think is too slow most of the time). The results are displayed in a separate window. To get a better reading of volatility, I placed two indicators in the same window (just drag and drop the second on top of the first one) with different values. That way you can get a sense of the session's volatility as well as the immediate volatility.

The settings I chose for the chart below are random - to figure out the best ones you would have to test it out yourself. I don't use the indicator myself but I have it in my arsenal. Also, if you are going to use two indicators in the same window make sure you set identical fixed minima and maxima to both indicators. Otherwise the comparisons are worthless.

I hope you're still subscribed to this thread, because I have a suggestion for you. I am currently researching volatility myself and I was thinking maybe you could do well to try out the classic Donchian channel indicator in another form. The Donchian channel draws channels connecting the highs and lows of n periods. When volatility increases, the channel gets wider. There is an indicator called Donchian Channel Width that measures exactly that (the same principle is used on the BB width indicator, which I too think is too slow most of the time). The results are displayed in a separate window. To get a better reading of volatility, I placed two indicators in the same window (just drag and drop the second on top of the first one) with different values. That way you can get a sense of the session's volatility as well as the immediate volatility.

The settings I chose for the chart below are random - to figure out the best ones you would have to test it out yourself. I don't use the indicator myself but I have it in my arsenal. Also, if you are going to use two indicators in the same window make sure you set identical fixed minima and maxima to both indicators. Otherwise the comparisons are worthless.

Attached File(s)

If you don't risk, you don't ever have to lose.