DislikedI am new to trading, still only using demo accounts. My opinions on the original question about trading without a stop loss are: 1. You are never trading without a stoploss as your account is a giant stop loss. 2. Of course it is ok to trade in this way as long as you are happy to eventually lose your account balance and have a money management plan that can cope with that. (i.e. not all of your money in that one trading account!) When I have found a system (or a few) that work and have been thoroughly tested, I plan on having multiple accounts...Ignored

Here is my take: the last thing first. Ditch the martingale strategy: the only way it works is with an infinite supply of money, and if you have such a supply, why waste your time in the forex?

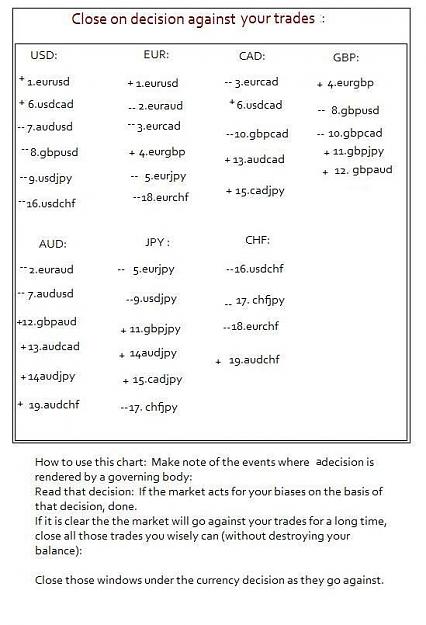

Second: Many systems work sometimes on a particular pair and sometimes not. The art then, consists of using a different system, or going to a pair on which it works. ( i.e.If you are making money on the pair, your system is working for you.)

some systems work better when the pair is climbing rapidly(Trending). Some systems work better when it is sitting level in a channel (consolidating). Some systems try to work well with both, and usually end up working poorly with either. With over twenty pairs to play with, all who behave similarly with only minor differences, you can almost always find a pair that is working well with your system. The big houses watch them all, and play any one when conditions seem to suit them.

Third, by trading without a stoploss, most people mean not using a fixed stoploss that takes you out of a trade because it hit a price, no matter what other conditions may exist at the time.

Fourth: Your balance is not a fixed stoploss. It varies. If you are successful your "stoploss" is getting further and further away.

Fifth: when you put money in your pocket the risk/reward ratio falls to Zero. The best of all outcomes has you putting more and more money in your pocket.

Let me put forth that the most meaningful ratio, one that bears constant watching is Account margin/Account balance.

Every time I close a trade in my account I update the margin in my this way:

First on the line is the largest margin for the month: Second is the smallest (and best) for the month. third is the current.

(You DO keep a journal, don't you?)

I mean every time, and that is frequently over a dozen times a day.

If I see a trade going into profit, I open the close trade window and watch it. When it stops going my way , I close it.

Then I look at that pair and (usually) re-enter. (Unless I see that it has stopped moving that way, of course).

Going above Margin/Balance ration of 50% is a signal that it is time for emergency actions.

Mine is currently at 29%

If you can keep that margin/balance ratio at less than 40% nothing else seems to matter, sooner or later you will be making money.

If you cannot keep it from becoming greater than 50% nothing else seems to matter, sooner or later you will lose.

Whether or not you use a fixed stop loss....

Margin is determined by (total lot size)* (number of trades in action). Note that margin takes no note of Take profit levels or stop loss levels.

The smaller the lot size you put on each trade, the more trades you can put into action for the same margin.

You can compensate for that small size with a bigger take profit. Margin makes no note of that. Your judgement is involved in asking yourself, "What take profit is so large that some price can come into profit, come close to take profit, while I am asleep, and go back into loss before I wake."

The more windows you have open, the more top-notch setups you will see, the more money you will make, the less time you will spend on setups that are not top-notch, and the lesser overall endemic risk you will encounter. What's not to like about that?

Finally: Put anything you hear or say from any source to the test of your own reason:

They may be wrong. I may be one of them.

Good luck in your future endeavors.