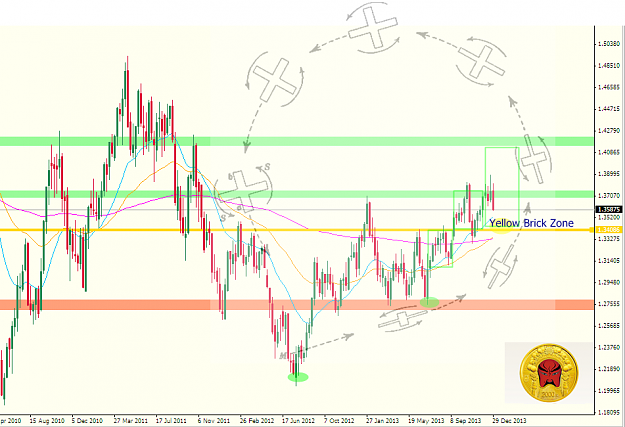

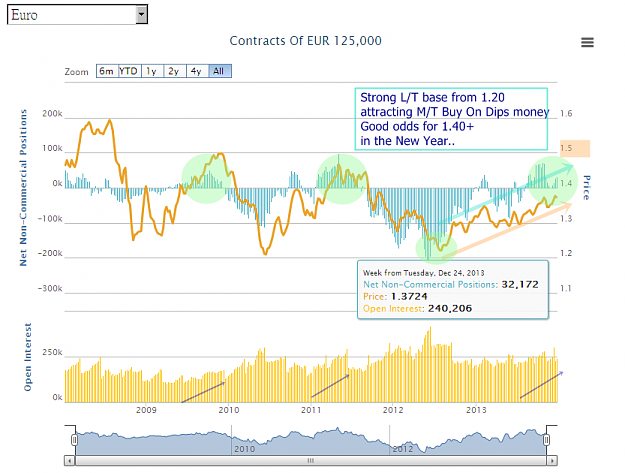

Was looking again at the end of last week for another bite if PA started to mix it again with the descending Guppy profile on the daily. That criteria is met, and so I am watching Cable and the Dollar for indications of an entry point.

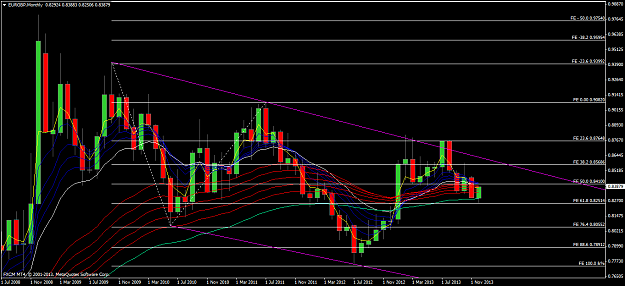

The monthly and weekly seem primed for a rejection south.

CNDollar... nice post.

Author of: For Pip's Sake! (Available at Amazon... :-) )