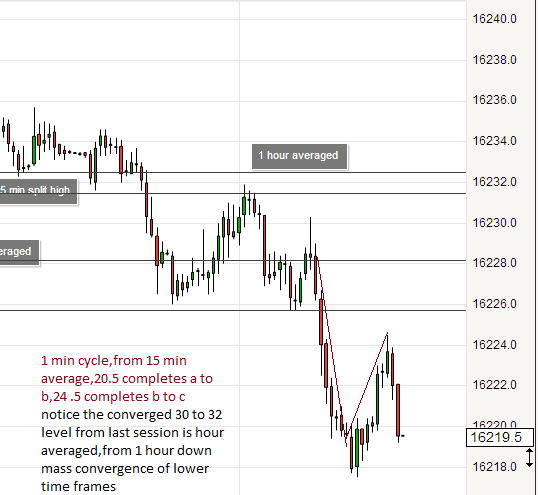

stop at break even 31 level,watch price at 45 level 5 min average

Attached Image

LUNC/USDT - Scalp Scalp Baby! 2 replies

To scalp or not to scalp? (Images included) 18 replies

Has anybody ever lost a scalp... 12 replies

15-minute Opening Range Scalp - newbie question, plz help 6 replies

DislikedReally interesting thread diceman - I've never considered daily averages as a level to trade, but it does make sense. Could I ask what you mean by "split high" and "split low"? I've search through the thread and couldn't find an explanation. Thanks PeteIgnored

Dislikedhi pete, to add one thing,the average is taken from past data,still very usefull in itself ,many good trading systems are based on averages,being moving or whatever, the split highs and lows especially when they converge are a peep into time yet to have happened,they will become tomorrows average .Ignored

Disliked{quote} Thanks very much - I'd be interested in seeing your calculations when ready and if you'd be so kind to share. It sounds almost like "market profile", but on a streamlined basis.Ignored

Disliked{quote} I would love to read about it too. William - diceman is one of the best scalpers here and one of a very few ppl who can post his entries live, very precise entries ; ) Learned a lot from his journal, i would recommend to read it all, lots of usefull stuff. just dropped by to say hi P.Ignored