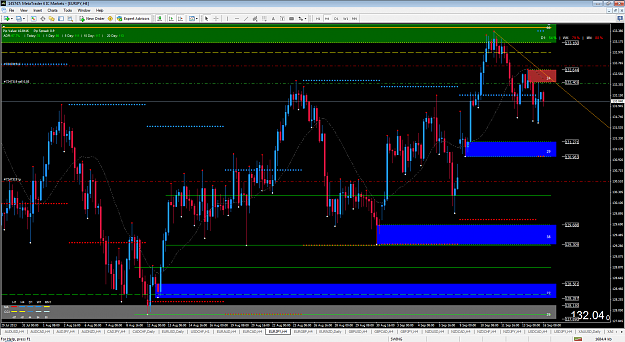

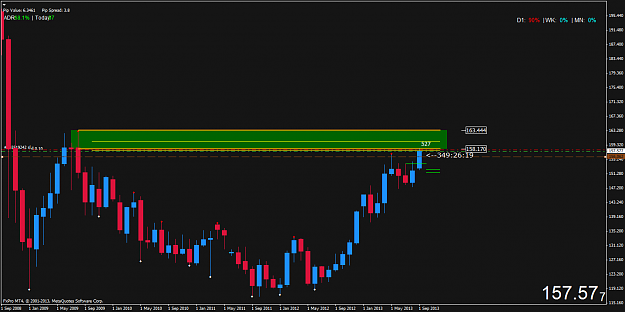

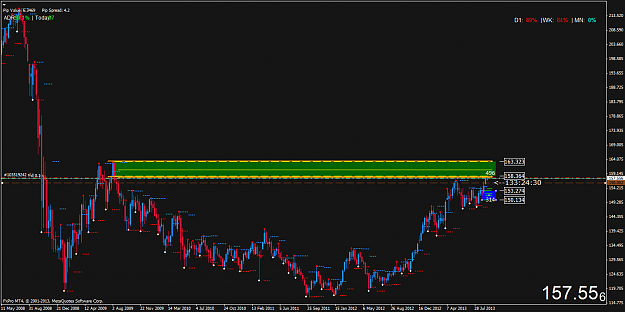

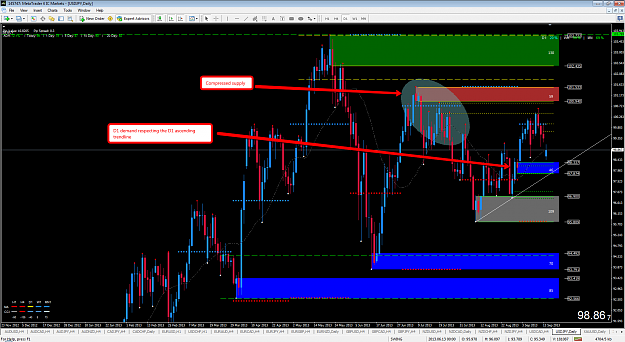

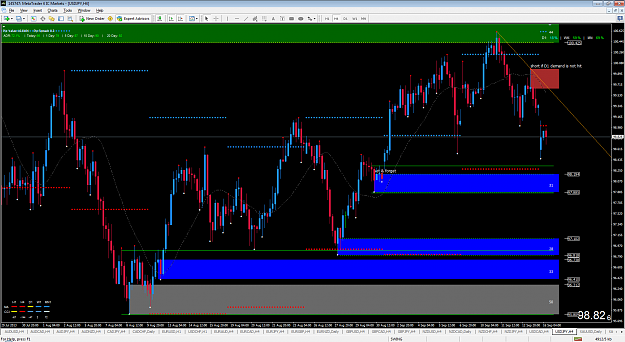

DislikedHi Ivan, your laughing about it, but it's sadly trueThe picture in D1 does not give me much reason to go long here in silver {image}

Ignored

I just commented on that same fact about the silver on my previous post, you were writting at the same time I was, but I pressed the SUBMIT button faster than you

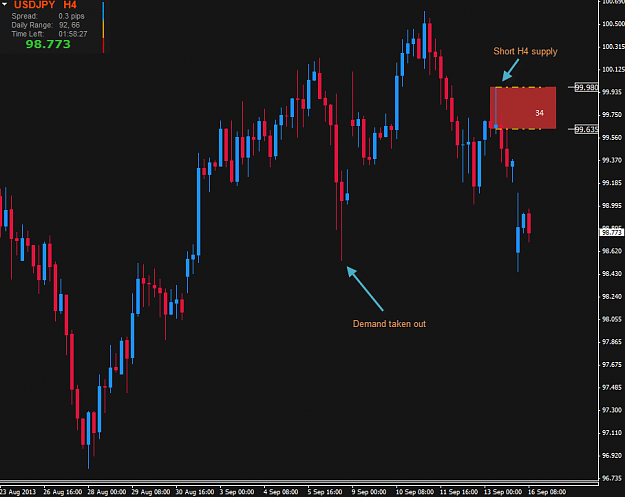

Longs are not allowed on SILVER now, this is key to understanding the methodology and how the SD higher timeframes play out! We just need to be patient, we can't go long and change direction because we see a couple of H1 supply zones taken out. It's all explained on Post #1. We need price to be hit the opposing SD zone, why? Because 99% of the time price just does that. Isn't that a good reason?

Alfonso

Set and Forget supply and demand trading community