Hello. This is ment for the forex rookies that are currently studying TA and feel like they aren't going much further forward. The FX market moves up with buyers and down with sellers like any other. We are interested in how to get long before others push price up and/or how to sell before others so we can profit from falling price. Finding clusters where an overwhelming area of orders are present is what we're looking for to enter or exit our trade and where to base our stop-loss. Lets start with retail broker Oanda showing their client's orders & positioning. (this is not 100% accurate as its a fractal view, anyone could chage their order at anytime, and it is an UNcentralized market.. get used to it) There are order news & rumor sources online.

The Setup:

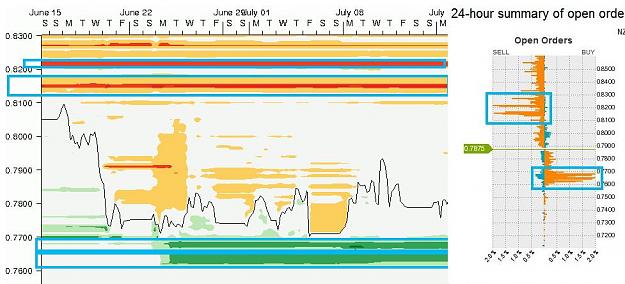

Attached in the Nzd/Usd order setup found on http://fxtrade.oanda.com/analysis/fo...r-book#NZD/USD along with those orders marked on the N/U 4hr price chart:

We have large sell orders at .8150 and right above .8200, along with buyers under the market .7620-.7700, with some sell stops under the lows.

Execution:

There are 3 basic confirmations to pay attention to.

1. Nzd/Usd in one of these zones, ready to trade a break or rejection of these levels.

2. Trade must be in line with market sentiment (longing based on a positive projected outlook, short on negative)

3. Nzd/Usd does not have the volume to move the market like the majors have, but follows Aud/Usd very closely bc of geographical proximity and both have the 2 highest interest rates of the majors. Our 3rd confirmation is on the Aud/Usd chart upon trade time so the need to follow Aud news/data is strong as well.

So guys, any trade ideas based on this information? Where do you see the best potential trades based on this info (entry,SL&TP levels)? Please no posting or using confirmation from indicators that are derived from price.

The Setup:

Attached in the Nzd/Usd order setup found on http://fxtrade.oanda.com/analysis/fo...r-book#NZD/USD along with those orders marked on the N/U 4hr price chart:

We have large sell orders at .8150 and right above .8200, along with buyers under the market .7620-.7700, with some sell stops under the lows.

Execution:

There are 3 basic confirmations to pay attention to.

1. Nzd/Usd in one of these zones, ready to trade a break or rejection of these levels.

2. Trade must be in line with market sentiment (longing based on a positive projected outlook, short on negative)

3. Nzd/Usd does not have the volume to move the market like the majors have, but follows Aud/Usd very closely bc of geographical proximity and both have the 2 highest interest rates of the majors. Our 3rd confirmation is on the Aud/Usd chart upon trade time so the need to follow Aud news/data is strong as well.

So guys, any trade ideas based on this information? Where do you see the best potential trades based on this info (entry,SL&TP levels)? Please no posting or using confirmation from indicators that are derived from price.