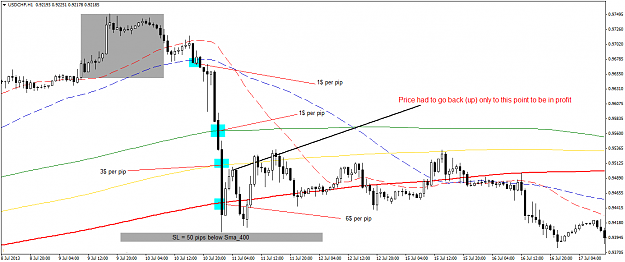

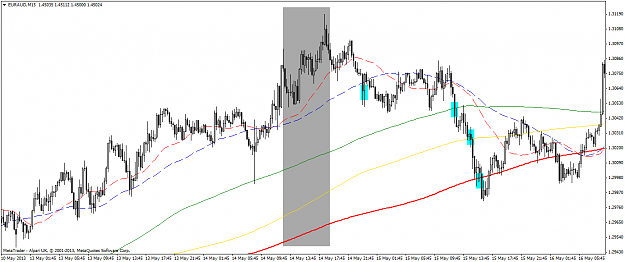

Disliked{quote} Hi I think you are too much involved with MA's.I use scaling in and out as well and to me its the key to success in Forex. Consider that 80% forex is NOT trending instead most of times what you think its a trend is in fact price is within channel.Once you see this in bigger TF then everything starts making sense. {image}Ignored

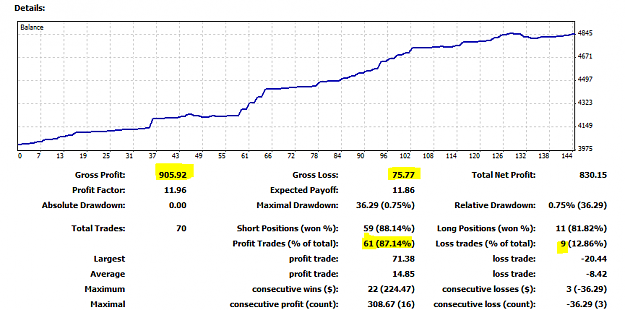

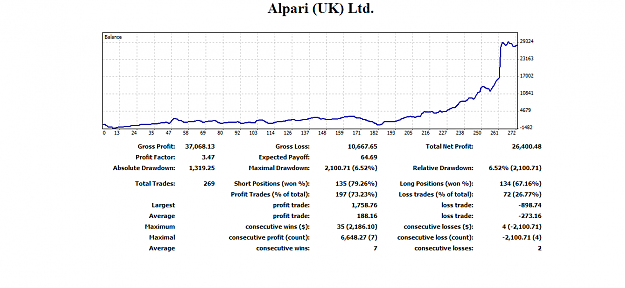

This time it works great!