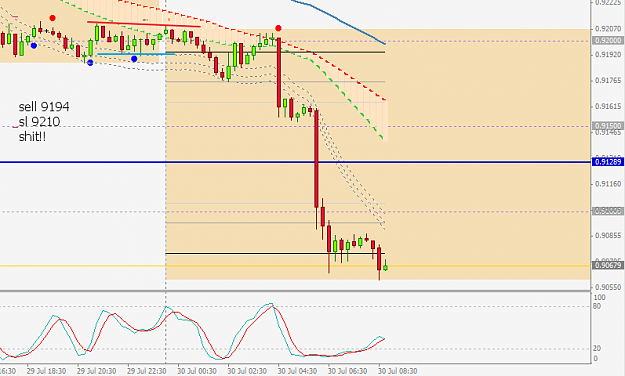

Disliked{quote} that's because if a trader was planning to long, these would be the ideal pricesIgnored

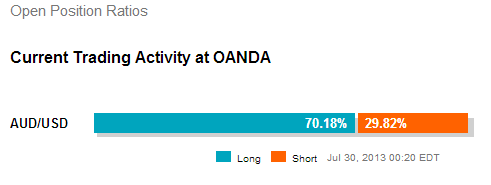

DislikedDespite drop in Aussie-Dollar, retailer's open position ratio continues to get more lopsided... {image}Ignored

Attached File(s)

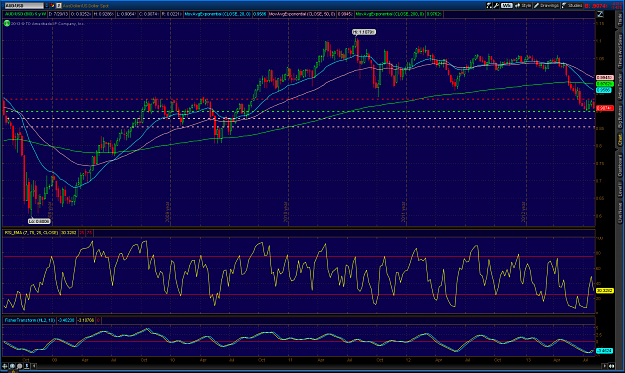

When the facts change I change my mind, what do you do sir