DislikedDo you guys think its possible for a counter trend on the USD/CHF? There is fresh demand on the daily (0.92374) which is just above an original demand area on the weekly (0.91347). There is also an original and fresh demand area on the daily (which i call OG Fresh) at 0.89706 which is sitting at the bottom of that weekly demand. The demand on the weekly is being respected, so is it possible it could go long?NT

Ignored

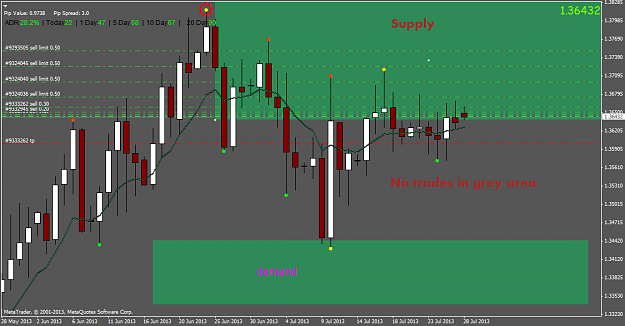

Monthly: We have a 9821 Supply Level Nov 2010 that is also a S/R line going back to March 2008. Supply was hit in July and Aug 2012 and again in May of 2013. Yes we are trading of the low made in Aug 2011 but since 2006 we are in a down trend. In addition, the swing at Supply/S/R previously mentioned has not been taken out. For my money the trend is down. Side note.. Interesting how we see a Supply Level with confluence to an S/R line. Just food for thought. For the record, Supply Demand is not Support Resistance but, they can appear at the same levels many times.

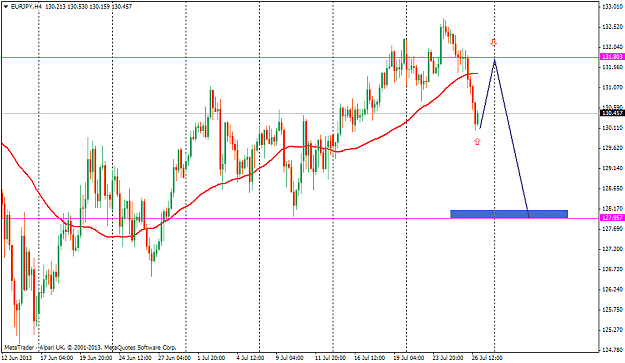

Weekly : We have a strong Demand @ 8078.. The market blasted off Sept 2011. Once that was completed price has meandered at best until now. Don't get me wrong there are some tradable areas along the way but they would be in the smaller TF.. We are focusing in the weekly as to give us some directional guidance.

Question:: If you look at the basic pattern of SD >> Rise-Base-Drop or Drop-Base-Rise.. Price is always moving between Supply and Demand, in all TF's. What do we see on the weekly? What do you think would be the most logical and obvious move? We are in a dominant TF.

The Weekly Base: We have LH's within the Base and if we go back ( looking left ) to about Nov 2010 we see the beginning of LH's .. Staring w/ July 2012, May 2013, July 2013...OMG a LH this month!!! Ding, Ding, Ding, Ding ......!!!!

SD Range: ( A name I have given to this pattern/trade set up ) Many times the Base of the pattern ( the easiest to see ) will form a Range. We have a pretty good one here. From 9900 to 9074.. So what do we look for ..We look for our SD levels to set up @ the extremes of the Range. Why?? Confluence between Range Extremes and S/D Levels. Currently price is trading in the middle and not at the extreme. So we wait.

Daily: Your pick (0.92374).. I see your level but I would offer up this observation. The 9103 Demand sits closer to the "extreme" for the range than does 9237. For a counter trade I want this added insurance. So I would take the trade at the Demand of 9103. See how price did not really come down to this 9103 but fell short on Jun 13, 2013.

The 8970 which sits outside the current range bring in an interesting observation. This could also set up for a counter trend. One could argue this may be the extreme of the range. Again, we may have confluence, thus opportunity.

Lastly..If price were to fail at any of the levels there may be an opportunity to short. Big levels ( obvious blast offs of price, weekly in this case) in the larger TF tend to act like Price Magnets ( strong propensity for price to move in that direction) and we definitely have one at 8078.

As always : I appreciate Alfonso allowing me to post on his thread.. His work, ideas and videos are most excellent!!

Many pips to all

TSD