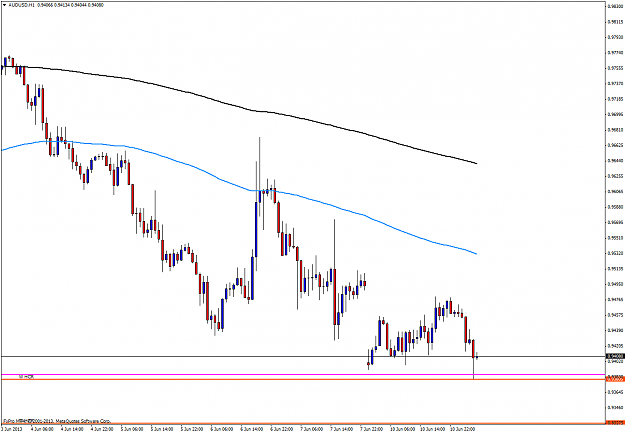

DislikedAnother SFP working out great in USDJPY. Iam currently backtesting the outcome of trading SFPs blindly (placing the entry order at the swingpoint without waiting for hourly confirmation)Ignored

Interesting idea, are you entering as the price initially breaks through the swing point, or as it returns back to it?

Jim