DislikedOk after a lot more back testing I have found widening the stop and adding into a position at the next level (averaging into the position) is not much better overall. Few reasons:Ignored

I'm not apposed to more trades... If I'm making $$! But if it's just treading water, It makes no sense. There are plenty of setups day in day out that I have found, it's just easier to cut the loss and move on.

[/quote] 2. drawdowns are larger. [/quote]

My goal is to Make Money Everyday. If I was trading a longer time frame - I could probably handle a larger draw down because I know that my wins would in be larger. Since I don't, I want to keep my losses to a minimum.

[/quote] 3. you are effectively adding to an initial losing position - wrong behavior pattern (better to take a small loss and reassess market for next setup as suggested by mongolian) [/quote]

[/quote] 4. in the trade a lot longer, where other potential set ups could have been taken and recovered the initial 6 pip loss[/quote]

See comment to #1 - it applies here as well.

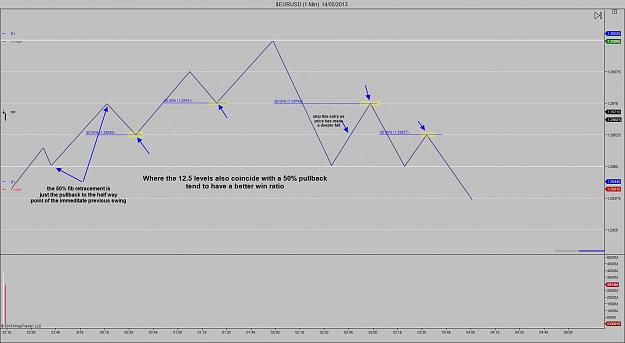

I will say that originally I was looking at your post from the standpoint of adding to the position basically @ my SL of 6 pips - not at an entire new 12.5 leg. I'm still a little bit curious about this. I know that PA can be 'sloppy' some days and shoot past the targets. (Especially the EURO/YEN pair) and having that flexibility could possibly be flexible. Just eyeballing PA it looks like there could be some potential there. Either to widen the stop beyond 6 pips to allow for that sloppiness to stay in the trade and/or use that as the ideal entry. I admit - it would take re-training myself as I have not looked @ this possibly and my eyes are pretty trained to look @ entries on the levels that have been described here in this thread. Thanks for contributing! Always looking for a an opportunity to grow and to expand my trading horizons. I'm still going to give this some work and see if there is anything there.

Mongolian