SP – I did not forget you. Considering I knew I had a lot to discuss on the topic, I pushed it back until I had the time to really think it through.

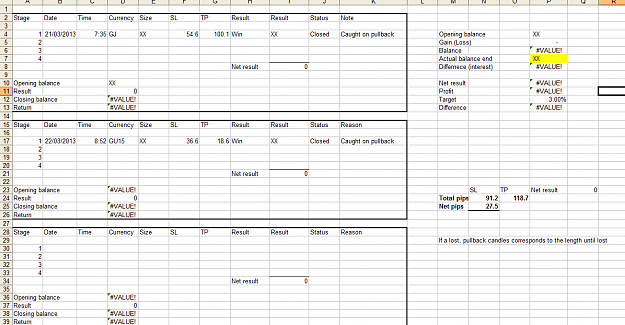

Here is my approach towards journal logging my trades (see attached pic).

The logic behind my approach goes as follows:

I have goals in life and with my trading; I only find it reasonable to write these goals down on paper and track actual results compared to that target. Although I might not be at a point in my trading career where I can gauge a realistic targets for my trading purposes (based on the time I can invest into my trading (this includes both trading time and analytical time), based on my equity and on my risk profile, as well as the end goal or purpose of trading – hence, everyone is different when it comes to targets), I set my targets low as a starting point, if I meet these targets , I’ll be happy, if I exceed them, then good, I’ll be able to attain my goals faster. I prefer that approach rather then delaying objectives because the original targets were unrealistic and unattainable. Some will consider this approach a bit pessimistic considering I use such low values, but it works for me and keeps me focused and disillusioned from the quick millions.

Back to my working papers, they include individual boxes tracking down all the CZ’s I get involved with. Although I don’t think I’m ready to go all out into Recovery #3 traders, I still computed in 4 possible trades on a single CZ. The information I track down is the date and time of the trade, the currency, the size, SL and TP, the ending results (Win or Loss) and the monetary result, the status of the trade and a custom note if needed – for instance, I like to note when I entered on pullbacks when I missed the initial breakout, helps me see that since pullbacks happen quite often, I can make winning trades when the indie shows me a loss.

I also included at the bottom of each trade set my opening equity balance, from which I add/deduct the net results of the whole CZ – not the single trade. This gives me a chance to see what the % of profit I get based on single CZs (which in turn helps me gauge my risk profile and decide how I want to approach my trades – do I want to use AMgale, MGale or no Martingale in my trading). I feel this aspect REALLY helps me compare the different styles and see the net result BASED ON MY TRADING.

Sure, the indicator shows me those beautiful results from using my settings – forward tested or not - but it doesn’t show me how much I risked, how much I gained and how many trades I took or did not take. It also doesn’t show me how the different pips affect my account overall when I use MGale or not. After as little as a month, I realized that using MGale actually slowed my progress when I targeted CZs up to a Recovery #3 approach – since I had to use extremely small lots on the initial breakout to keep the risk on my account acceptable. Then, when I tested a Recovery #1-#2 approach, I noticed that, since I was able to have bigger lots while maintaining an adequate risk profile, although I had more losses, my wins had a much bigger impact on my account. The indicator won’t show you who you are and how your approach affects your account. We can estimate all we want, we can speculate all we want, we won’t know until we keep track of it. It was among the first hint FXH gave us, with or without the indicator it still applies and holds true.

Finally, on the right hand side, the monthly totals add up together, I simply type in my actual ending balance to compute the differences (emerging from interests or swaps) which in turn gives me my monthly net result, the % ROE and then compares it to my target (again, I set this very low for now and will adapt this as I go – better be safe than sorry with my MM, I would not want to set unrealistic targets and get discouraged down the road).

Sorry for the hefty, slightly off topic post.

Here is my approach towards journal logging my trades (see attached pic).

The logic behind my approach goes as follows:

I have goals in life and with my trading; I only find it reasonable to write these goals down on paper and track actual results compared to that target. Although I might not be at a point in my trading career where I can gauge a realistic targets for my trading purposes (based on the time I can invest into my trading (this includes both trading time and analytical time), based on my equity and on my risk profile, as well as the end goal or purpose of trading – hence, everyone is different when it comes to targets), I set my targets low as a starting point, if I meet these targets , I’ll be happy, if I exceed them, then good, I’ll be able to attain my goals faster. I prefer that approach rather then delaying objectives because the original targets were unrealistic and unattainable. Some will consider this approach a bit pessimistic considering I use such low values, but it works for me and keeps me focused and disillusioned from the quick millions.

Back to my working papers, they include individual boxes tracking down all the CZ’s I get involved with. Although I don’t think I’m ready to go all out into Recovery #3 traders, I still computed in 4 possible trades on a single CZ. The information I track down is the date and time of the trade, the currency, the size, SL and TP, the ending results (Win or Loss) and the monetary result, the status of the trade and a custom note if needed – for instance, I like to note when I entered on pullbacks when I missed the initial breakout, helps me see that since pullbacks happen quite often, I can make winning trades when the indie shows me a loss.

I also included at the bottom of each trade set my opening equity balance, from which I add/deduct the net results of the whole CZ – not the single trade. This gives me a chance to see what the % of profit I get based on single CZs (which in turn helps me gauge my risk profile and decide how I want to approach my trades – do I want to use AMgale, MGale or no Martingale in my trading). I feel this aspect REALLY helps me compare the different styles and see the net result BASED ON MY TRADING.

Sure, the indicator shows me those beautiful results from using my settings – forward tested or not - but it doesn’t show me how much I risked, how much I gained and how many trades I took or did not take. It also doesn’t show me how the different pips affect my account overall when I use MGale or not. After as little as a month, I realized that using MGale actually slowed my progress when I targeted CZs up to a Recovery #3 approach – since I had to use extremely small lots on the initial breakout to keep the risk on my account acceptable. Then, when I tested a Recovery #1-#2 approach, I noticed that, since I was able to have bigger lots while maintaining an adequate risk profile, although I had more losses, my wins had a much bigger impact on my account. The indicator won’t show you who you are and how your approach affects your account. We can estimate all we want, we can speculate all we want, we won’t know until we keep track of it. It was among the first hint FXH gave us, with or without the indicator it still applies and holds true.

Finally, on the right hand side, the monthly totals add up together, I simply type in my actual ending balance to compute the differences (emerging from interests or swaps) which in turn gives me my monthly net result, the % ROE and then compares it to my target (again, I set this very low for now and will adapt this as I go – better be safe than sorry with my MM, I would not want to set unrealistic targets and get discouraged down the road).

Sorry for the hefty, slightly off topic post.