DislikedWhat TF ?

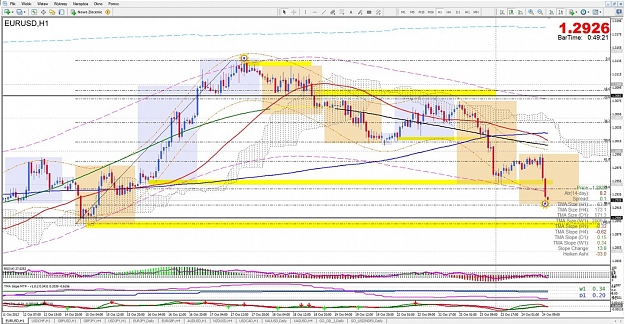

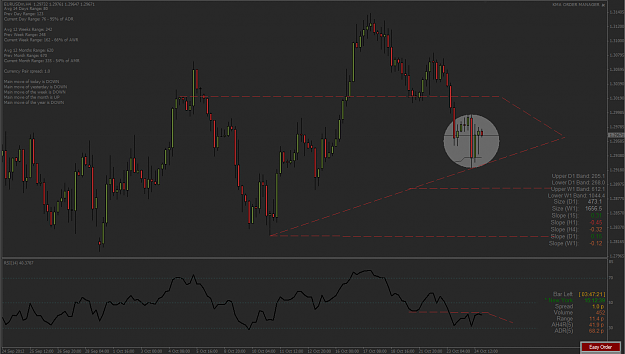

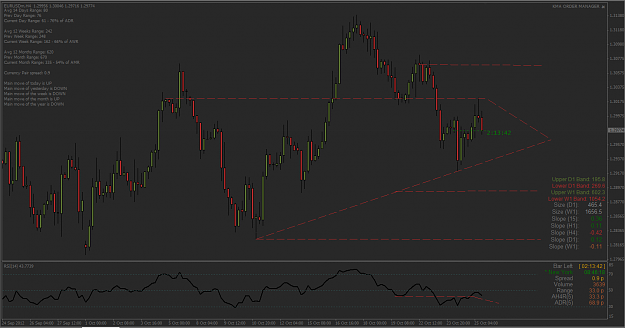

Speaking of EG, Nice short is setting with a nice divergence too, notice the slope he's crossing the 0 Line, short after the Retest Of the upper H1 Band maximum or the Middle line Minimum, Good observation.Ignored

- Post #13,423

- Quote

- Edited 4:06am Oct 24, 2012 3:23am | Edited 4:06am

- Joined Apr 2011 | Status: Cut Your Losses, Ride Your Winners. | 2,898 Posts

Master Your Setup, Master Your self. (NQoos)

- Post #13,425

- Quote

- Oct 24, 2012 10:00am Oct 24, 2012 10:00am

- Joined Apr 2011 | Status: Cut Your Losses, Ride Your Winners. | 2,898 Posts

Master Your Setup, Master Your self. (NQoos)

- Post #13,426

- Quote

- Oct 24, 2012 10:16am Oct 24, 2012 10:16am

- Joined Apr 2011 | Status: Cut Your Losses, Ride Your Winners. | 2,898 Posts

Master Your Setup, Master Your self. (NQoos)

- Post #13,427

- Quote

- Oct 24, 2012 11:05am Oct 24, 2012 11:05am

Of all the things I've lost I miss my mind the most .

- Post #13,428

- Quote

- Oct 24, 2012 1:29pm Oct 24, 2012 1:29pm

Of all the things I've lost I miss my mind the most .

- Post #13,430

- Quote

- Oct 24, 2012 7:15pm Oct 24, 2012 7:15pm

Of all the things I've lost I miss my mind the most .

- Post #13,431

- Quote

- Oct 25, 2012 5:29am Oct 25, 2012 5:29am

- Joined Apr 2011 | Status: Cut Your Losses, Ride Your Winners. | 2,898 Posts

Master Your Setup, Master Your self. (NQoos)

- Post #13,433

- Quote

- Oct 25, 2012 6:28am Oct 25, 2012 6:28am

- Joined Apr 2011 | Status: Cut Your Losses, Ride Your Winners. | 2,898 Posts

Master Your Setup, Master Your self. (NQoos)

- Post #13,436

- Quote

- Edited 9:40am Oct 25, 2012 9:27am | Edited 9:40am

Of all the things I've lost I miss my mind the most .

- Post #13,437

- Quote

- Oct 25, 2012 10:07am Oct 25, 2012 10:07am

- Joined Apr 2011 | Status: Cut Your Losses, Ride Your Winners. | 2,898 Posts

Master Your Setup, Master Your self. (NQoos)

- Post #13,438

- Quote

- Oct 25, 2012 10:08am Oct 25, 2012 10:08am

- Joined Apr 2011 | Status: Cut Your Losses, Ride Your Winners. | 2,898 Posts

Master Your Setup, Master Your self. (NQoos)

- Post #13,439

- Quote

- Oct 25, 2012 11:26am Oct 25, 2012 11:26am

- | Membership Revoked | Joined Jun 2011 | 9,885 Posts

To free Gazans of Hamas, use whatever it takes.

- Post #13,440

- Quote

- Edited 6:35am Oct 26, 2012 6:23am | Edited 6:35am

- | Membership Revoked | Joined Jun 2011 | 9,885 Posts

To free Gazans of Hamas, use whatever it takes.