Hi ya Davit..

Thanks for your help!

niiice trade, break of inside bar to

when you say a powerful S/R level you basically mean a floating S/R level yes?

cool!

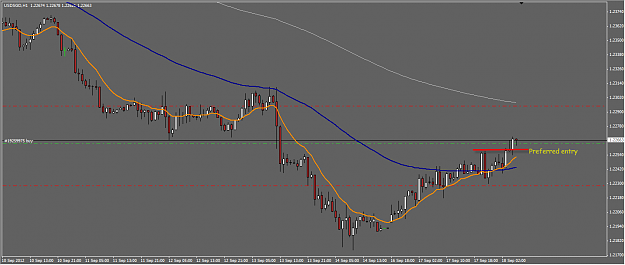

Just wondering do you use it in a case of a break of the 200EMA level long and then entry on a pull back retouch of the 200EMA to go long?

Cheers,

Adrian

Thanks for your help!

QuoteDislikedHere is what I just did. I retook the Cad at 9740 and closed it right at 9757 under 200EMA anticipating trend reversal to down.

QuoteDislikedI just know that lot of banks use 200EMA in their trading and its a powerful S/R level hence I am trying to be in sink with this system.

QuoteDislikedSo to sum up I like to see both 72EMa and 200EMA in same direction for assurance and use this system as an entree

Just wondering do you use it in a case of a break of the 200EMA level long and then entry on a pull back retouch of the 200EMA to go long?

Cheers,

Adrian