DislikedHi ya FX Pro..

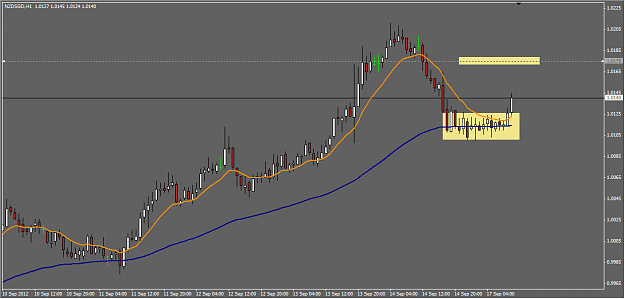

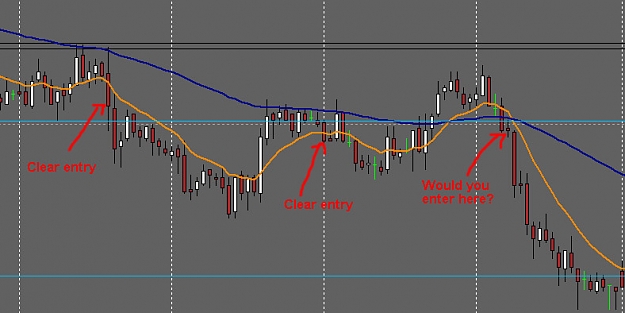

Could you please put a couple of chart examples when you get a chance of when you would take the first trade after the Ema's have crossed over giving a different direction in trend...showing the first entry you would take also where you would place your stop?..

Thanks for any help on this

Cheers,

AdrianIgnored

Cheers

FX-Pro