Sniffing Snake's Tracks...

- Post #2,061

- Quote

- Jul 13, 2012 11:13am Jul 13, 2012 11:13am

- Joined Jun 2008 | Status: Stay Ahead | 315 Posts

- Post #2,062

- Quote

- Edited 1:18pm Jul 14, 2012 12:49pm | Edited 1:18pm

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #2,063

- Quote

- Edited Jul 15, 2012 3:41am Jul 14, 2012 4:25pm | Edited Jul 15, 2012 3:41am

- Joined Mar 2007 | Status: Member | 1,142 Posts

- Post #2,064

- Quote

- Jul 15, 2012 1:35pm Jul 15, 2012 1:35pm

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #2,065

- Quote

- Jul 16, 2012 1:11am Jul 16, 2012 1:11am

- Joined Jun 2008 | Status: Stay Ahead | 315 Posts

Sniffing Snake's Tracks...

- Post #2,066

- Quote

- Edited 11:24am Jul 16, 2012 2:16am | Edited 11:24am

- Joined Mar 2007 | Status: Member | 1,142 Posts

- Post #2,067

- Quote

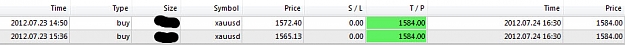

- Jul 24, 2012 9:41am Jul 24, 2012 9:41am

- Joined Jun 2008 | Status: Stay Ahead | 315 Posts

Sniffing Snake's Tracks...

- Post #2,068

- Quote

- Jul 29, 2012 4:33pm Jul 29, 2012 4:33pm

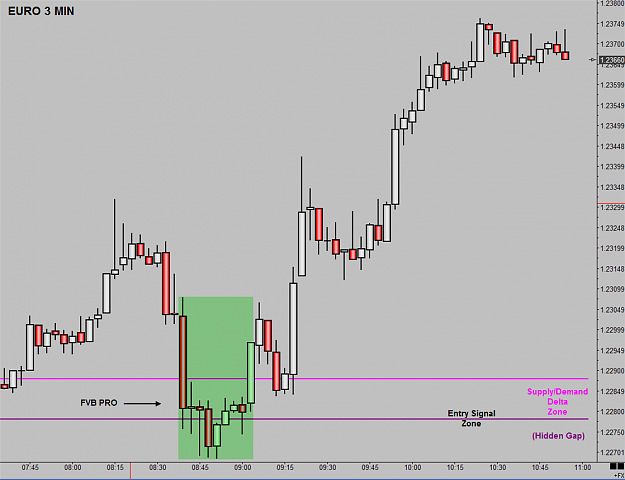

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #2,069

- Quote

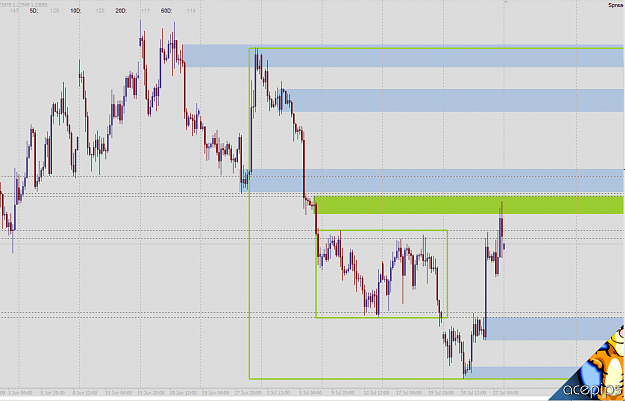

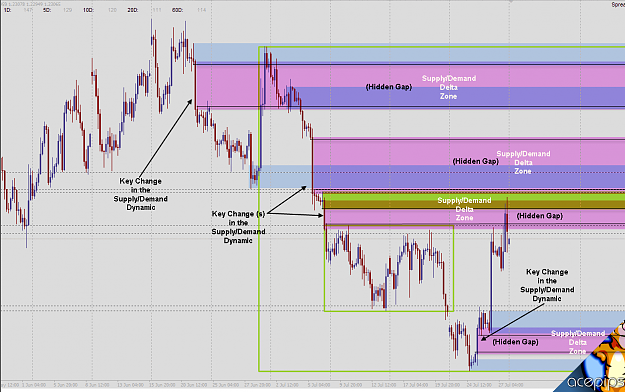

- Jul 30, 2012 9:51am Jul 30, 2012 9:51am

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #2,070

- Quote

- Jul 31, 2012 2:07pm Jul 31, 2012 2:07pm

- Joined Aug 2010 | Status: Tööröh | 14,292 Posts

Hero calls followed by margin calls...

- Post #2,071

- Quote

- Aug 7, 2012 10:08am Aug 7, 2012 10:08am

- Joined Mar 2007 | Status: Member | 1,142 Posts

- Post #2,072

- Quote

- Aug 29, 2012 3:00pm Aug 29, 2012 3:00pm

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #2,074

- Quote

- Sep 8, 2012 9:26am Sep 8, 2012 9:26am

- Joined Jun 2008 | Status: Stay Ahead | 315 Posts

Sniffing Snake's Tracks...

- Post #2,076

- Quote

- Nov 22, 2012 9:51am Nov 22, 2012 9:51am

- Joined Jun 2012 | Status: Signed In | 5,303 Posts

- Post #2,077

- Quote

- Nov 22, 2012 10:58am Nov 22, 2012 10:58am

- Joined Jun 2012 | Status: Signed In | 5,303 Posts

- Post #2,078

- Quote

- Nov 22, 2012 2:11pm Nov 22, 2012 2:11pm

- | Membership Revoked | Joined Mar 2010 | 3,853 Posts

All systems of divination, like music itself,work through patterns.

- Post #2,079

- Quote

- Nov 23, 2012 3:35am Nov 23, 2012 3:35am

- Joined Jun 2012 | Status: Signed In | 5,303 Posts

- Post #2,080

- Quote

- Nov 23, 2012 5:34am Nov 23, 2012 5:34am

- Joined Jun 2012 | Status: Signed In | 5,303 Posts