hey Nexas - nobody is doubting you I'm sure.

I would welcome your continued videos.

I would welcome your continued videos.

3 Bar Fractal with mid-bar and bar on each side 11 replies

Change indicator narrow range bar NR4 to wide range bar WR4 0 replies

Range Bar Trading with Nexas 62 replies

How do I determine what size range bar is comparable to a daily bar? 6 replies

Pin bar, pin bar, pin bar 0 replies

DislikedHi All,

Sorry I've been away, been busy having a baby... our third in fact :-)

There are a few replies on here and I will answer all of them as soon as I can but a little busy at the moment :-).

I hope to get through them all by Monday so please bare with me.

Just wanted you all to know that I hadn't forgotten you.

NexasIgnored

Dislikedhey Nexus

Is this leading to a commercial venture? as I see you opened a journal in Oct, and now you have it with your singing and dancing video introIgnored

Dislikedscjohn......I would love to hear about your setups. The averages just weren't flowing very well for Nexas's setups most of this week. Although I made money I had to scratch for it.....kadiddleIgnored

DislikedHi Scjohn,

But I welcome your thoughts and suggestions, I am not nearly arrogant enough to think I know it all :-), I just know what works for me.

Thanks for your input.

NexasIgnored

DislikedHi Fourx,

No this thread isn't a commercial venture.

Do I have outside ventures? Yes I do, but I have not brought that into this thread or forum.

However due to the question being asked and in the interest of not breaking any rules I have sent a mail to the FF Admin with regards to how I should answer the question, unfortunately they have not replied yet.

So if they come back to me and say due to my other interests I should be moved to the commercial forum then I apologize and will probably stop posting as much as it was meant to be...Ignored

DislikedYou can do either. Your win rate will increase by waiting for 8 range EMA's to set up. It really is a personal choice, it depends on whether you are feeling aggressive or not.

For me personally, I like to watch the price and the sentiment. For example, whilst the EZ was going into the toilet I would be much more likely to take a less than perfect setup to the short side rather than the long side. Does that make sense?Ignored

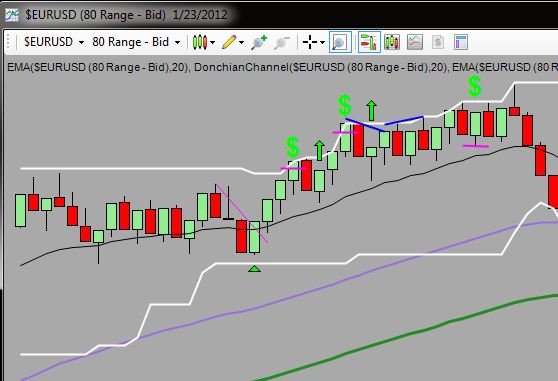

DislikedAttachment

Here's a description of the "fade the corners" trade setup I mentioned in an earlier post.Ignored

DislikedHi Darren,

Are you a pilot too?

Thanks for your post, now all you need to do is build confidence with this system and stick to it.

It won't be perfect all the time but as long as you are consistent, it will pay you.

NexasIgnored

DislikedSorry, been out horribly sick!

I used to fly, now I ride a cubicle!

Keep it up, I want some more vids!

-DarrenIgnored

DislikedThanks Nexas.

A combination of 3 of your 4 pip range trades and one of my "fade the corners" trades (at 9:37 EST) gave me a great U.S. morning session today while the EURUSD was moving inside a tight 39 pip range all session.

I passed on a winning 4 pip range bar Nexas trade at 10:48 EST as the downtrend looked like one of your "non-harmonics" and it had a poor reward risk ratio. But like you say, "What can you do?" The other 3 worked great.

Time to take the dogs for a walk in the woods.Ignored

Dislikedhey scjohn

Any chance you could attach a chart showing your trades, it would be a big help.

ThanksIgnored

DislikedOn this one, I'll go over the "fade the corners" trade. Will do the others later. Have an appointment this afternoon.

Attachment

The signal came at 9:37 EST. I wasn't wild about it as the target was at only about a 1 to 1 reward / risk ratio. However, it was with the trend and note the bottom of the channel stairstepping up toward a flat upper channel. In my experience, this type of pattern tends to break to the upside and sometimes explosively (especially in such a strong uptrend) so I took the trade.

In order to get...Ignored

DislikedLooks good.

What pairs do you trade?

Do you trade ranging pairs like EURGBP or EURCHF, too?Ignored