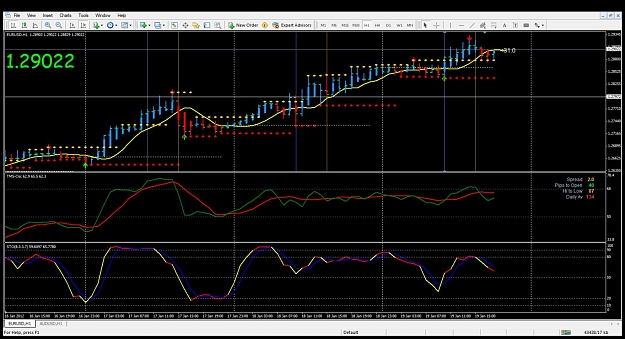

Long on AUDCAD. PA bounced from SMA and TDI was returning from outside blue band. TP is top of SHI Channel.

- Post #2,961

- Quote

- Edited 4:10pm Jan 19, 2012 3:37pm | Edited 4:10pm

- | Joined Feb 2011 | Status: Member | 188 Posts

- Post #2,964

- Quote

- Jan 19, 2012 5:54pm Jan 19, 2012 5:54pm

- | Joined Feb 2011 | Status: Member | 188 Posts

- Post #2,965

- Quote

- Jan 19, 2012 6:25pm Jan 19, 2012 6:25pm

- | Joined Apr 2008 | Status: Member | 1,312 Posts

- Post #2,966

- Quote

- Jan 19, 2012 6:41pm Jan 19, 2012 6:41pm

- Joined Nov 2008 | Status: Member | 45,185 Posts

Honesty is a very expensive gift. You wont find it in cheap people.WBuffett

- Post #2,972

- Quote

- Jan 20, 2012 1:33am Jan 20, 2012 1:33am

- | Commercial Member | Joined Aug 2011 | 2,409 Posts

X-man the legendary conqueror of markets

- Post #2,973

- Quote

- Jan 20, 2012 2:00am Jan 20, 2012 2:00am

- | Commercial Member | Joined Aug 2011 | 2,409 Posts

X-man the legendary conqueror of markets

- Post #2,974

- Quote

- Jan 20, 2012 2:45am Jan 20, 2012 2:45am

- | Commercial Member | Joined Aug 2011 | 2,409 Posts

X-man the legendary conqueror of markets

- Post #2,977

- Quote

- Jan 20, 2012 2:56am Jan 20, 2012 2:56am

- | Commercial Member | Joined Aug 2011 | 2,409 Posts

X-man the legendary conqueror of markets

- Post #2,979

- Quote

- Jan 20, 2012 3:23am Jan 20, 2012 3:23am

- | Commercial Member | Joined Aug 2011 | 2,409 Posts

X-man the legendary conqueror of markets

- Post #2,980

- Quote

- Jan 20, 2012 3:28am Jan 20, 2012 3:28am

- | Commercial Member | Joined Aug 2011 | 2,409 Posts

X-man the legendary conqueror of markets