hello all,

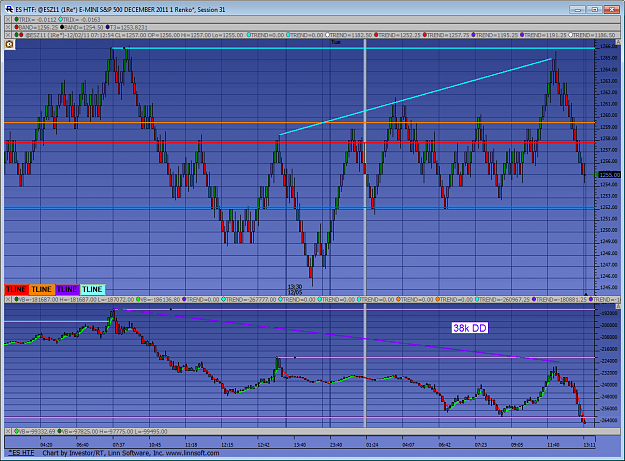

as the post earlier, target price hit with almost no drawdown.

as the post earlier, target price hit with almost no drawdown.

DislikedHello all,

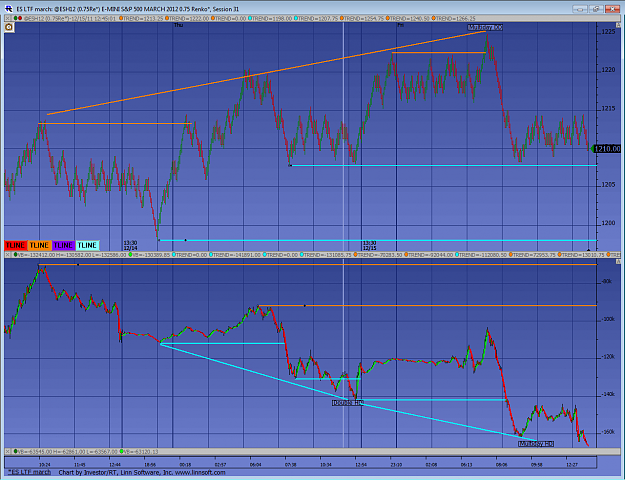

i am starting a thread to show that price forecasting is indeed possible once we think out of the box. attached is the price forecasting for ES for 21 Nov 2011

Timeframe (T) = Day trade

Trend (T) = Down

Entry (E) = Sell once price breaks 120100

Stop (S) = 121500

Target (T) = 118925, 118950Ignored