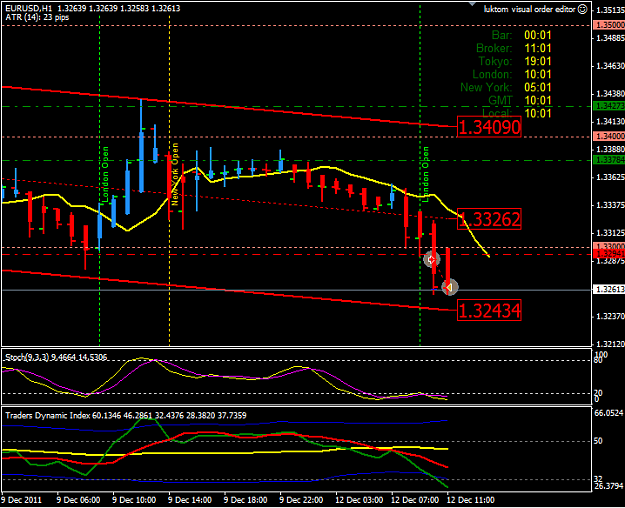

DislikedOops... X-Man pls clear my confusion as well then. For me a pull back candle will only be something with a very small body, large wicks and where the price closes in the opposite direction than the open. For the Euro, only one condition was satisfied i.e. price closed in the opposite direction. Not the other two. Whereas for the Swissy all three were satisfied. Had I been looking at candlesticks only I would have taken the long since the pull back appeared at previous S&R.

Pls refer to the candle formed 36 mins back.Ignored

A conservative trader should wait until the wick is longer than the body to be safe.

X-man the legendary conqueror of markets