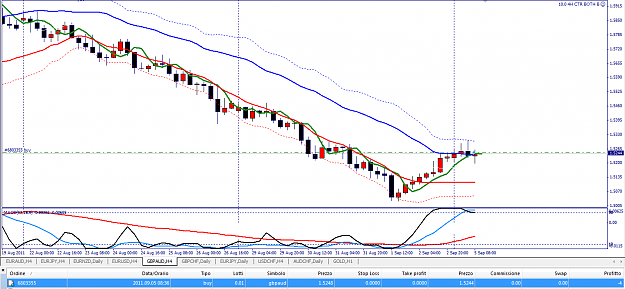

This week was a closing out of my recovery trades. The market reversed almost across the board. I felt I was on the wrong end of several CHF trades so I just closed them for losses and recovery traded the rest. Still increased my account 1% this week and my DD is now under 2.5%. Looking forward to another week.