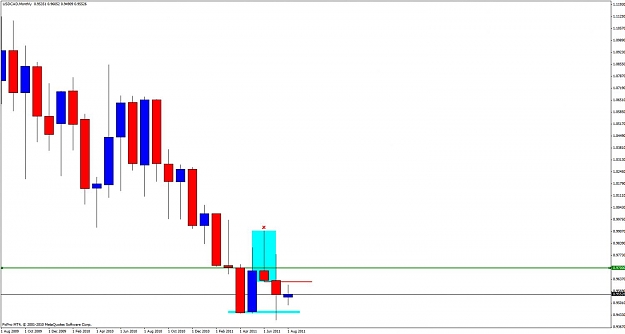

This looks like a very sexy setup on Copper if you've got the minerals to short metals: Bearish outside bar/ "PPZ"/ Round Number (4.500)/RSI divergence.

Unfortunately I don't have a live account which offers it.

Unfortunately I don't have a live account which offers it.