DislikedYou don't.

There are no certainties in this game. All you have are probabilities.

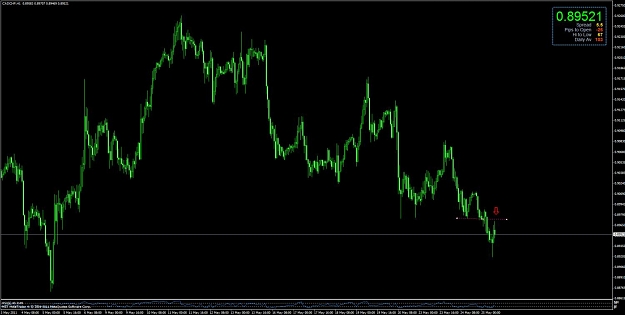

There are certain factors I look for to place the odds in my favour that price will bounce. These include but are not limited too;

- making sure the level is significant s/r (preferably with confluence - particularly the ATR)

- that price would make sense bouncing when I consider the highest timeframe (the D1)

- that the level not been hit too many times (particularly from the same side) in recent activity

- the the level...Ignored

I hope you accept me into your webinar.

Final question, you don't refer to any indicator at all? Not even MA and Stochastic?

Do you know any good source of dvd course (other than yourself of course) that you think is a good start to learn the basic of price action trading?