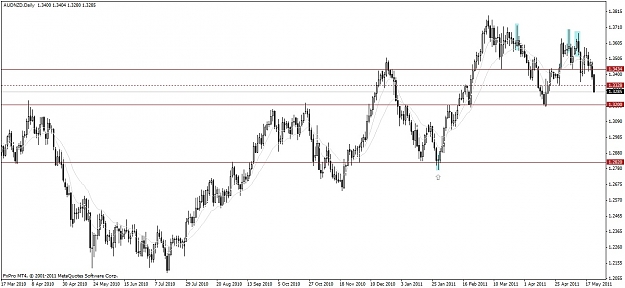

DislikedI was bidding to buy that as it broke the lows for a classic fade.

But you are right; normally I would look for this area to break and trade a rounded retest.Ignored

If I understand correctly, there are some situtations you will buy at these locations also, right ?