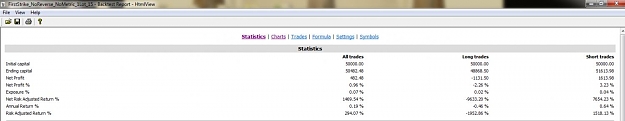

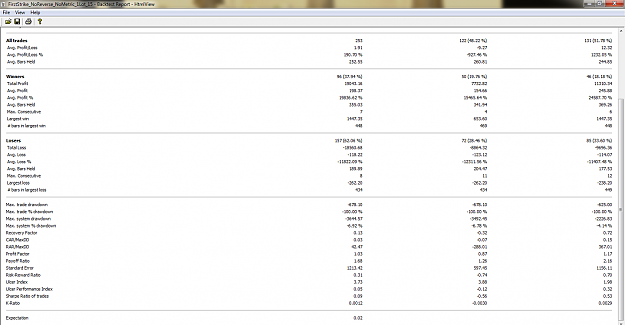

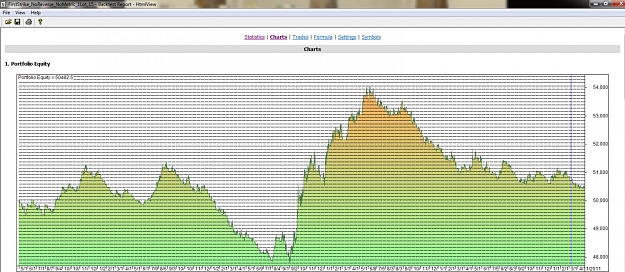

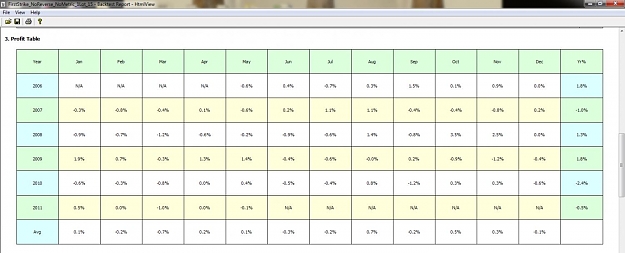

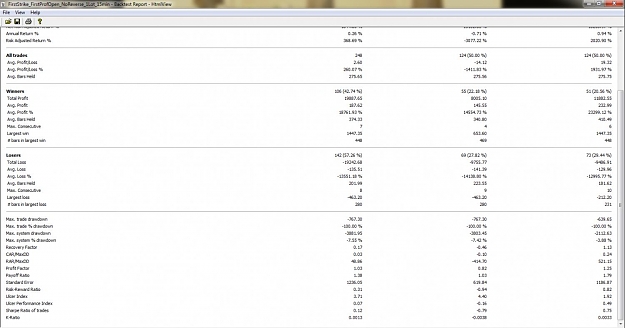

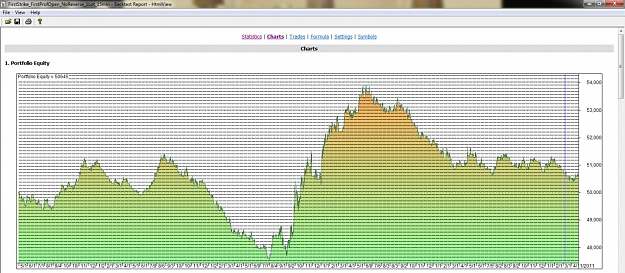

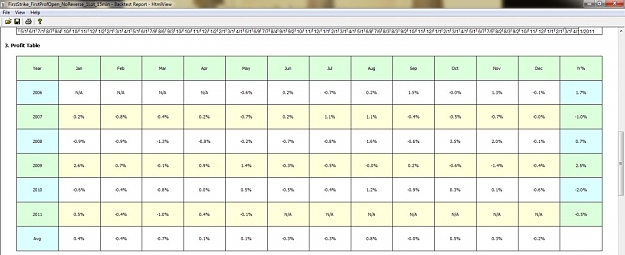

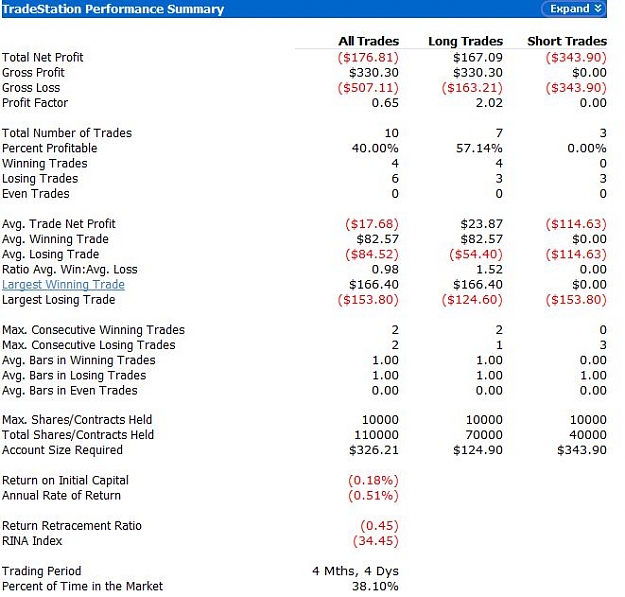

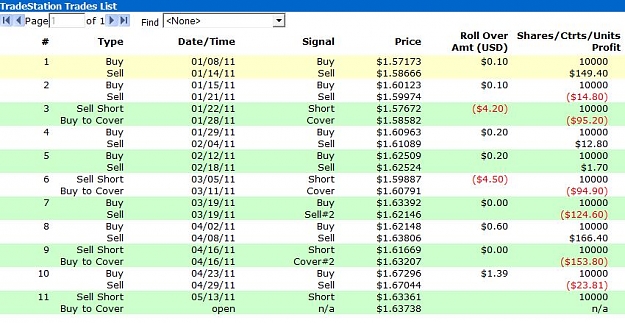

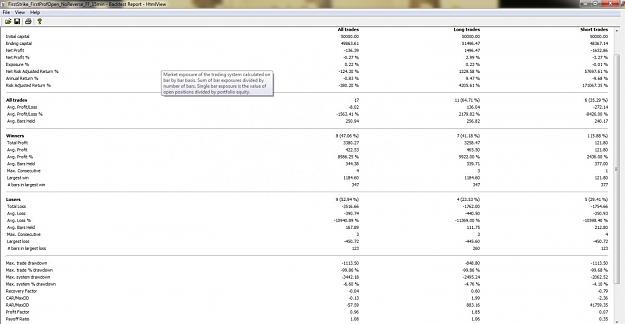

DislikedIn a nutshell, by the original rules posted, this system is a loser over the past 4+ years. Tradestation summary report and equity graph are attached.

Since it was quite clearly pointed out earlier that this is "a once a week trade method ..... NOT HOURLY...... ", I guess I will leave my comments at that. For those that aren't afraid to bend the rules sometimes, I'd encourage you to experiment with it... it is quite a performer on H1 when traded in the direction of the trend and some sensible money management is applied.Ignored

So until now we have 18 week trade on GU since 3 January 2011.....

I would recommend 1:200 Leverage and starting capital $10,000 with one standard lot for every trade.....

Thank you so much for comparison data....

The Markets just don't care what U believe...