DislikedHi,

I am a new in trading, my job is from morning 9 to 6 pm evening singapore time.

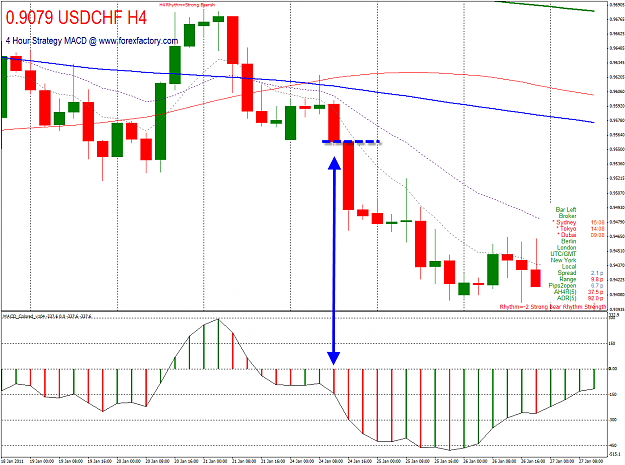

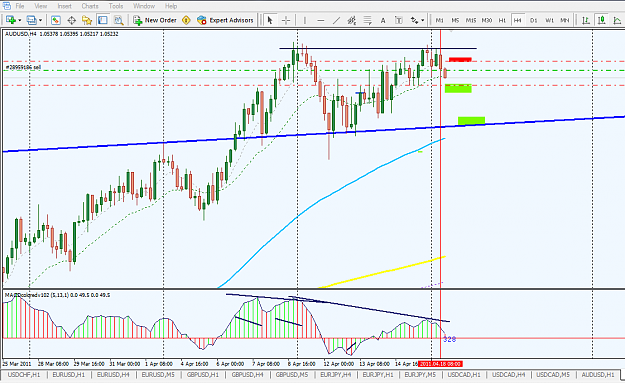

This 4 hour strategy is very much neat and easy but i faced the problem is exit strategy as i dont have a that much time to sit infront of PC, so can u please give me some tips for exit strategy in this system.

Thanks & Regards,

Umesh PatelIgnored

Nice to meet a singaporien here. Sg time is one of the best time zones in the world, it covers Asia, London and US timings.

As for the exiting your trade, you will need to read the tread. There's no hard and fast rule. There are so many rules in exiting the trade. You would have to find the one or a few that suites your personality.

Andrew.