- Post #18,486

- Quote

- Apr 12, 2011 9:44am Apr 12, 2011 9:44am

- Joined Sep 2010 | Status: I'm not here... or am I? | 3,999 Posts

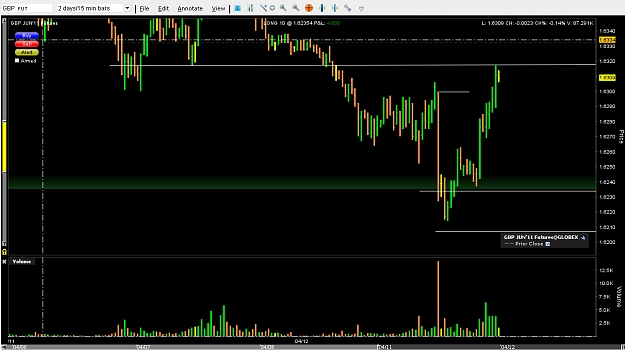

Today's zone = Tomorrow's opportunity!

- Post #18,487

- Quote

- Apr 12, 2011 9:46am Apr 12, 2011 9:46am

- Joined May 2009 | Status: Trading, Not Posting | 2,130 Posts

- Post #18,488

- Quote

- Apr 12, 2011 9:51am Apr 12, 2011 9:51am

- | Joined Jan 2009 | Status: Fading the specs | 1,374 Posts

- Post #18,489

- Quote

- Edited 10:06am Apr 12, 2011 9:54am | Edited 10:06am

- | Joined Jan 2009 | Status: Member | 1,259 Posts

- Post #18,490

- Quote

- Apr 12, 2011 9:55am Apr 12, 2011 9:55am

- | Commercial Member | Joined Mar 2008 | 9,261 Posts

- Post #18,491

- Quote

- Edited 10:44am Apr 12, 2011 10:18am | Edited 10:44am

- | Joined Feb 2009 | Status: Member | 286 Posts

- Post #18,492

- Quote

- Apr 12, 2011 10:36am Apr 12, 2011 10:36am

- | Commercial Member | Joined Jan 2010 | 600 Posts

Greetings, BeLikewater

- Post #18,493

- Quote

- Apr 12, 2011 10:39am Apr 12, 2011 10:39am

- Joined Oct 2010 | Status: Looking at a few more charts... | 1,195 Posts

- Post #18,494

- Quote

- Apr 12, 2011 10:43am Apr 12, 2011 10:43am

- Joined May 2009 | Status: Trading, Not Posting | 2,130 Posts

- Post #18,495

- Quote

- Apr 12, 2011 11:02am Apr 12, 2011 11:02am

- | Joined Jan 2009 | Status: Fading the specs | 1,374 Posts

- Post #18,496

- Quote

- Apr 12, 2011 11:14am Apr 12, 2011 11:14am

- Joined May 2009 | Status: Trading, Not Posting | 2,130 Posts

- Post #18,497

- Quote

- Apr 12, 2011 11:15am Apr 12, 2011 11:15am

- Joined May 2009 | Status: Member | 1,879 Posts

Markets are not efficient, rather they are effective - Jones

- Post #18,498

- Quote

- Apr 12, 2011 11:21am Apr 12, 2011 11:21am

- | Joined Mar 2009 | Status: Member | 392 Posts

Blogging daily now at www.volume.zone

- Post #18,500

- Quote

- Apr 12, 2011 11:27am Apr 12, 2011 11:27am

- Joined Oct 2010 | Status: Looking at a few more charts... | 1,195 Posts