Change is the only constant

- Joined Sep 2010 | Status: I'm not here... or am I? | 3,999 Posts

Today's zone = Tomorrow's opportunity!

- Joined Sep 2010 | Status: I'm not here... or am I? | 3,999 Posts

Today's zone = Tomorrow's opportunity!

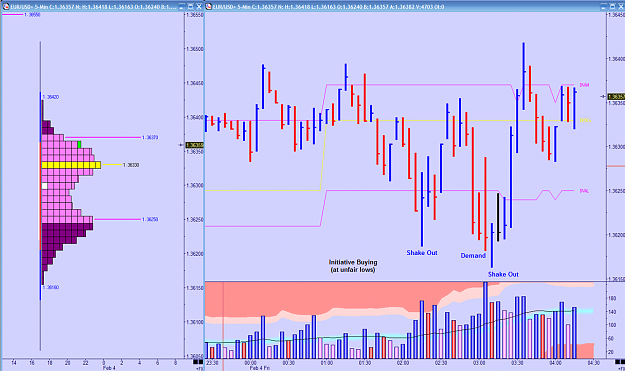

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect