DislikedI agree. What DS has shared already should be enough to get everyone started in the direction that will help their trading. If it hasn't, maybe they weren't meant to have this information?

Darkstar, if you continue refining your book to the point that anyone can pick it up and make profit from it, do you worry you've let the cat out of the bag? I'm sure your own personal trading is way beyond that, at this point, though. I would be thrilled to read your book as it is. Part of what makes order flow so awesome is the self-discovery process that takes...Ignored

So don't worry.

What I'm worrying about now is this thread xD

I now get why threads like these always disappear, I'm starting to feel the urge to hide it underground, and this urge is fighting hard with the need to dig deeper and deeper in the subject.

Quoting xXTrizzleXxDislikedOh. My. Goodness.

I was actually about to fall asleep when I envisioned how this could be applied. This assumes there are no significant fundamental changes in the associated currencies of the pair though?

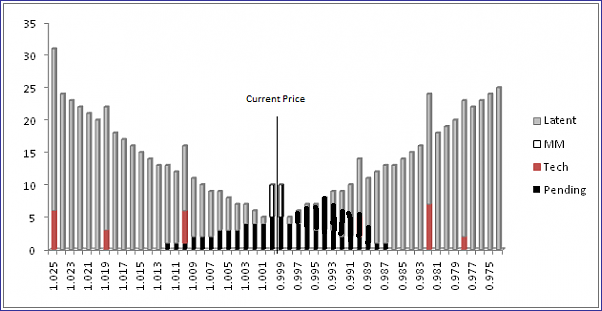

The way I'm putting this together, is that DarkStar's illustrations have given a model for taking advantage of the extremes of ranging markets. Let's assume that Market Mover A wants to buy below the perceived value of USD/CHF. Upon reaching the lower extreme of the range, we can assume that we will have participants who will be positioning themselves long, and would set their sell-stops below the range. Market Mover A has his buy-limit orders positioned slightly below this range, and to enable his order to be filled, quickly executes an sell market order of sufficient size to push price to these sell-stops, which when hit, will liquidate into his buy-limits. This will be further facilitated by uninformed traders, who think this is a genuine break-out to the downside. The speed of execution will be such that it is fast enough to avoid a significant amount of latent liquidity turning into pending orders, (which would make things harder for Market Mover A by essentially building a liquidity wall to his buy-limits). Market Makers would then need to adjust their bid/ask to take into account this changed liquidity situation, resulting in the production of the illustrated liquidity vacuum. When his order is filled, the sell market order previously open, is then closed by means of a buy market order equal or larger to the former, which gets price moving into Market Mover A's intended direction back to the perceived fundamental value of the currency. As price heads back upwards, the Market Makers would have to deal with the liquidity vacuum, by shifting their bid/ask quotes to account for it, to protect their inventories.

(note: Orders will be placed within the vaccuum, but I am making the assumption that the liquidity provided by them will be sufficiently small so that they can be considered insignificant, due to the small time interval over which this occurs)

On a chart this should look like a strong move upwards once more, even though the volume (size of the order) which caused it, may not seem proportionally large. Additionally, uninformed participants who were tricked by Market Mover A's pseudo-break out, would be squeezed. Their buy-stops, which they placed for protection, would, when executed - further empower the up-move, along with informed participants, riding the move back to the perceived fundamental value. They are in essence going to profit from the mispricing.

I may be viewing things from an angle that is..."too close to the situation"; too infinitessimal, but I'm hoping the logics of this are sound, and would like to hear others' interpretations so far.

grkfx, has essentially provided an excellent model for understanding the dynamics of trends - I would expound on my interpretation of it, but must finish my homework.

With the dynamics of ranges and trends covered, and understanding where the high-probability points of entries are, we should be able to anticipate a move to break-even quickly, such that our exposure time is reduced.

Everybody loves a free trade. http://cdn.forexfactory.com/images/s.../yim/happy.gifIgnored

You pretty much got it, to me that's A way for this to be done.

But that's only 1 of the opportunities i think.

Everything turns aroung this "vacuum" that gets created, a disequilibrium that can be exploited.

To exploit these "inefficiencies", these repeating patterns, we actually need to know what to search for, but some of the things have been listed from Darkstar.

Quoting DarkstarDislikedAnd thats just one factor that can be analyzed with this model. Think about how a large order hitting the book would alter the profile... or what happens pre/post news events.. or how a fast price change would interact with the slow conversion of latent interest to pending orders... or what happens when a central bank steps in to defend a price.. or how market makers act to maintain a balanced book... or or or... the list is endless.Ignored

-Liquidity drying up for fear/waiting, and i think this liquidity becomes "latent"

-Liquidity getting eaten out from big orders

Large orders hitting the book, pre/post news or any other fast change in price, just as Darkstar states.

One thing, are latent orders what people use to call "Icebergs" in orderbook?