Well isn't this quite embarassing.

It seems to me as if I am the threadstarter, and I am the one who right now knows/UNDERSTANDS the least of all of you.

SMJones you have pointed out to me what (I don't know what a stop hunt really looks like because I don't believe in my ability to find a stop hunt) a liquidity disequilibrium looks like, if that is what that USDCHF picture is?

Then this gives me an idea of what I should look for.. First I was thinking along the lines that I would see stop hunting(and liquidity disequilibrium) with candlesticks, then I thought it was an area.. Now it seems like it is a little bit of both.

I have attached your picture there once again jones and this is my take on it. I assume this is not a stop-hunt but rather a liquidity disequilibrium. (If it was a stop-hunt then please explain to me, where would these stops be? This doesn't seem like an obvious place for stops..)

Now I don't understand much of liquidity and equilibirum/balance YET, but I am reading more and more.

Anyway, this is how I see it and PLEASE explain to me if I am really wrong now.

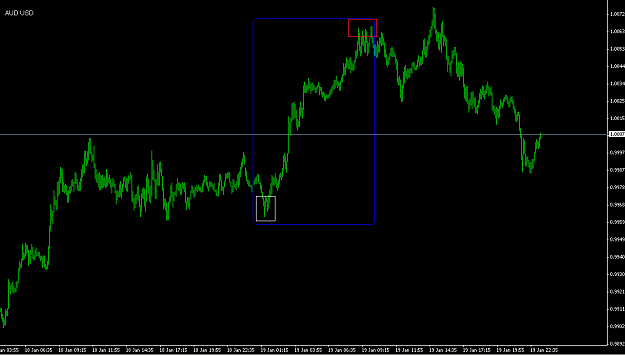

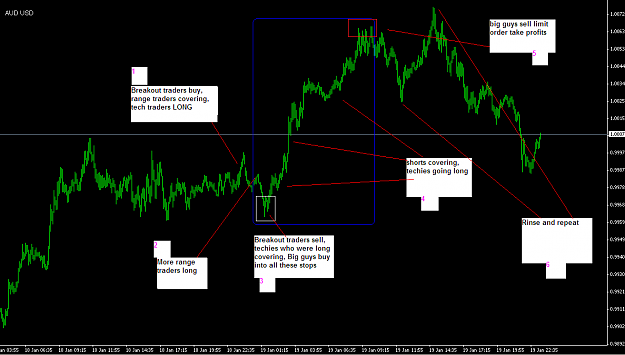

In the green box we had an equilibirum or balance where the price was trading sideways because traders agreed upon the value/price. Then someone decided that it dollars was worth more he/she traded it UP and this spike was caused due to disequilibirum? = Much more bidders than sellers. Now after this there was a balance in price again but it broke down and I have a read line there of where I believe the stops should be.. Since price moved down like that there I am certain that there wasn't any balance (that's why it trended down).

But I am 100% sure I am missing some large parts here in my thinking. Why did it move down sharp instead of staying in a consolidation like before the sharp move up? Did the guy who bought have to sell his position causing this sharp move down?

It seems to me as if I am the threadstarter, and I am the one who right now knows/UNDERSTANDS the least of all of you.

SMJones you have pointed out to me what (I don't know what a stop hunt really looks like because I don't believe in my ability to find a stop hunt) a liquidity disequilibrium looks like, if that is what that USDCHF picture is?

Then this gives me an idea of what I should look for.. First I was thinking along the lines that I would see stop hunting(and liquidity disequilibrium) with candlesticks, then I thought it was an area.. Now it seems like it is a little bit of both.

I have attached your picture there once again jones and this is my take on it. I assume this is not a stop-hunt but rather a liquidity disequilibrium. (If it was a stop-hunt then please explain to me, where would these stops be? This doesn't seem like an obvious place for stops..)

Now I don't understand much of liquidity and equilibirum/balance YET, but I am reading more and more.

Anyway, this is how I see it and PLEASE explain to me if I am really wrong now.

In the green box we had an equilibirum or balance where the price was trading sideways because traders agreed upon the value/price. Then someone decided that it dollars was worth more he/she traded it UP and this spike was caused due to disequilibirum? = Much more bidders than sellers. Now after this there was a balance in price again but it broke down and I have a read line there of where I believe the stops should be.. Since price moved down like that there I am certain that there wasn't any balance (that's why it trended down).

But I am 100% sure I am missing some large parts here in my thinking. Why did it move down sharp instead of staying in a consolidation like before the sharp move up? Did the guy who bought have to sell his position causing this sharp move down?