There are no Data coming out of Australia this week.

However, what we do have are China CPI & GDP which I consider as "risk events" for AUD.

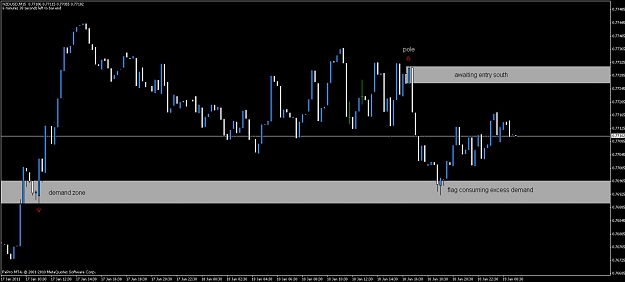

My trade plan would be to sell AUDUSD hours before these chinese news and close them before news comes out... IF these chinese news are bad, AUDUSD would continue to sell lower *BUT* will pick up after a few hours afterwards. BUT IF chinese news are extremely BAD, it will continue down hill.

BTW. Where are the Australia Iron Ore mines located? Is it affected by the current floods? From what I know, the flood is affecting the Coal mines - which isnt what the chinese are importing. China has very large coal mines.

However, what we do have are China CPI & GDP which I consider as "risk events" for AUD.

My trade plan would be to sell AUDUSD hours before these chinese news and close them before news comes out... IF these chinese news are bad, AUDUSD would continue to sell lower *BUT* will pick up after a few hours afterwards. BUT IF chinese news are extremely BAD, it will continue down hill.

BTW. Where are the Australia Iron Ore mines located? Is it affected by the current floods? From what I know, the flood is affecting the Coal mines - which isnt what the chinese are importing. China has very large coal mines.